Technology has been making our lives easier and improving all the sectors. Forex has greatly benefited from it and has become the best version of itself with AI-driven analytics, an automated trading system, and more. But there are some downsides as well.

ResearchGate mentioned, “The fast use of blockchain technology, cryptocurrencies, and electronic trading has had a profound influence on the world’s foreign exchange market, creating both difficulties and potential for market regulation and exploitation.”

While there might be some adverse effects, technology is still important in long-term improvement for Forex. And in this article, I’ll mention how.

It’s no secret that trading was once a domain reserved for global banks, financial institutions, and the wealthy elite. Technology doesn’t have any geographical barrier, allowing participants from all over the world to access the market and make money.

Online commerce networks have changed access, offering educational resources, demo accounts, and user-friendly interfaces that even allow novice dealers to take part.

There are several influencers like Alex Gonzalez who demonstrate how someone can generate wealth by purchasing and selling. This inspires more novices to start building their portfolio.

The introduction of mobile trading apps has further catalyzed this trend, allowing trades to occur virtually anywhere, at any time. Because of this shift, there is more competition and diversity.

Furthermore, secure and fast communication networks now enable safe global participation. Because these beginners can access it easily, this shows that the technology has eliminated the gap between complex market operations and everyday users.

Online platforms like Tradu make trading more user-friendly with safety measures like encryption and multifactor authentication. These features greatly contribute to safeguarding finances and building trust among users. Participation in the forex market is also encouraged, and more people find themselves investing.

The fusion of accessible cutting-edge technology and stringent security protocols exemplifies the adoption of modern software to meet evolving consumer needs.

Artificial Intelligence and big data analytics are necessary in this modern era not only for forex but for every other business. It’s the most effective and enhanced analytic solution.

AI tools can sift finished immense datasets to determine patterns and correlations that would be impracticable for human analysts to detect without significant time and resources.

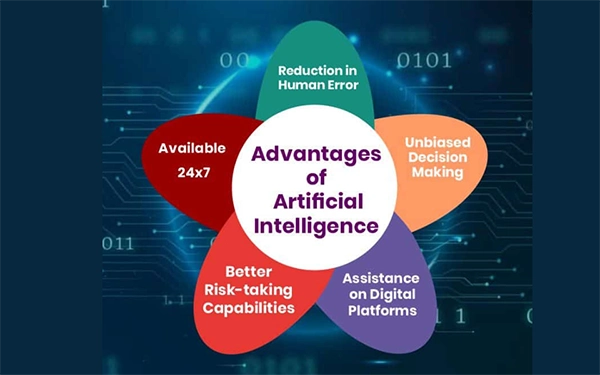

By analyzing historical data, market conditions, and global events, AI-driven systems generate accurate market predictions. And later it is used by traders to create data-driven strategies. It offers several other benefits that can be seen in the infographic below.

Since the market is quite volatile, it’s quite beneficial for forex. Minor shifts can cause major financial implications, making data-based steps crucial. AI integration has enhanced analytical precision and opened doors to more sophisticated and responsive trading strategies.

Technology is only going to advance further, does that mean we will say an even better introduction in forex? With such rapid and dramatic evolution, the forex market will undoubtedly present fresh possibilities and challenges for traders across the globe.

Forex transactions used to take a lot of time to be processed but since it got integrated with the latest technology it is faster than ever. Several exchange platforms have reduced latency and disruption is minimized.

With real-time data and execution expertise, we are met with increased trade efficiency. Automation also plays a major role in this and with the advanced algorithm, decision-making has become easier.

In this fast-paced world, things must be done without taking too much time as it can mess up other operations.

DID YOU KNOW?Forex deals with $6.6 trillion worth of transactions every single day, making security their primary concern!

Regulation and risk remain the major concern as it can’t be taken lightly or there would be severe consequences. Features like stop loss and limit orders prevent people from losing a lot of money.

These are management techniques that are usually present in all e-trading platforms. Traders can set when to enter or leave, this helps against the volatile market. Traders’ private data is also protected and with encryption, sensitive information is safeguarded.

Many of these applications are immune to any kind of cyberattacks and protect the assets of those availing the services. It’s pretty clear that without the latest technology, this wouldn’t have been possible, as hackers have been coming up with ways to scam and steal.

So, in conclusion, I can only say one thing and that is without the advanced technology Forex would’ve been still struggling. People would be concerned about their security and might lose a lot of money.

But that is not going to be the case anymore, because the generation of technology has made it a hundred times better and introduced several features that have been greatly benefiting others.

Whether ensuring secure transactions or analyzing bulk data is done seamlessly and safely.