If you run a business today, taking credit card payments is pretty much non-negotiable.

Yet have you ever scratched your head wondering where those card details go when a customer enters them at checkout?

Who’s actually approving or denying the sale on the other end?

Unpacking what happens behind the scenes when someone clicks “pay” is key.

This gives you an understanding of how transactions route through banks, networks, and verification checks so you optimize the process.

This article breaks it down in plain language – no finance degree is required.

We’ll explore the key players, step-by-step data flow, debit differences, timelines, and tips so you can accept payments like a pro.

So who are the main players directing this intricate flow of dollars and data?

Well, in most cases, there are four key parties involved in the facilitation of credit card processing from start to finish:

This ecosystem of moving parts is referred to as the four-corner model.

Each corner – merchant, acquirer, cardholder, and issuer – plays a vital role in coordinating in sequence to facilitate the purchase payment process consumers often take for granted.

So what exactly happens behind the scenes when a customer whips out their wallet, enters those 16 digits into your checkout page, and triumphantly clicks “pay”?

Interesting Fact:

In 2023, credit card utilization was recorded at 6%.

Let’s map it out step-by-step:

The first stop on the payment data train is the merchant’s acquirer bank, which acts as the financial guardian and connector to card networks.

The acquirer bundles up the transaction details and fires it off to the appropriate credit network, like Visa or Mastercard.

Think of card networks as the power lines transmitting energy.

The network then pings the issuing bank that gave the paying customer their card, asking necessary questions – is this really John Smith trying to buy this basket of baking supplies?

Does he have $47.28 in available financial standing to pay for it?

The issuer reviews the transaction details against the cardholder account profile to authenticate identity and determine if funds exist.

If both check out, it zaps back an affirmative through the reversal card network route.

Finally, approval confirmation arrives back at the acquirer, who relays the good news to the eager merchant.

If all is well, the payment is successfully processed and items are shipped. The acquirer facilitates the funds transfer to the merchant too.

Amazingly, all this happens in mere seconds before the customer can even refresh the confirmation page or recheck their phone.

It’s a pretty ingenious process allowing anyone to safely access their funds from a piece of plastic whenever, wherever.

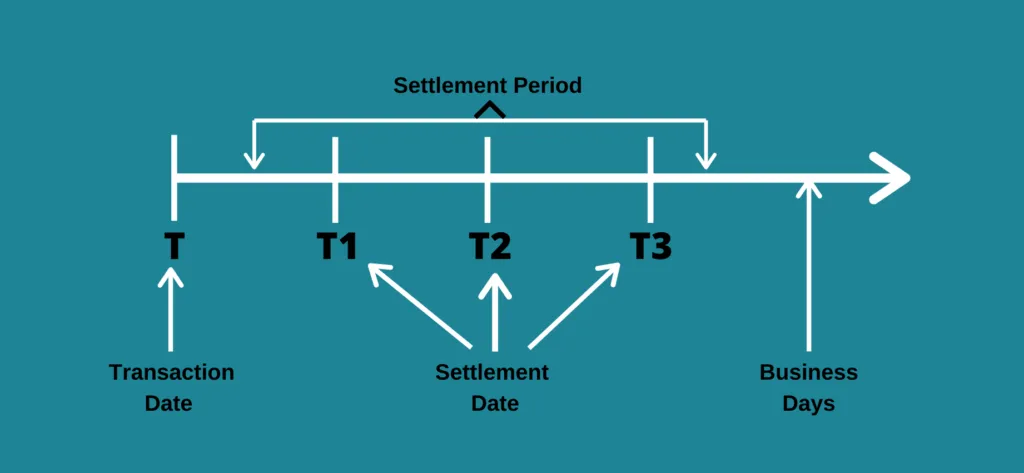

When charge card verification happens in the blink of an eye, payments still take a little time to fully process behind that instantaneous authorization fanfare.

Generally, 1-2 business days is the industry standard for transactions to finalize, though actual settlement varies.

Weekends, holidays, and fraud reviews can all delay completed processing.

The good news is merchants receive authorization at checkout, signaling it’s safe to release goods to the customer without eating costs.

Funds debited from the customer and deposited to the merchant do lag slightly.

Processing debit payments utilizes a very similar four-corner model infrastructure as charge cards. However, there are some key differences in how exactly transactions are routed and regulated.

Statistics:

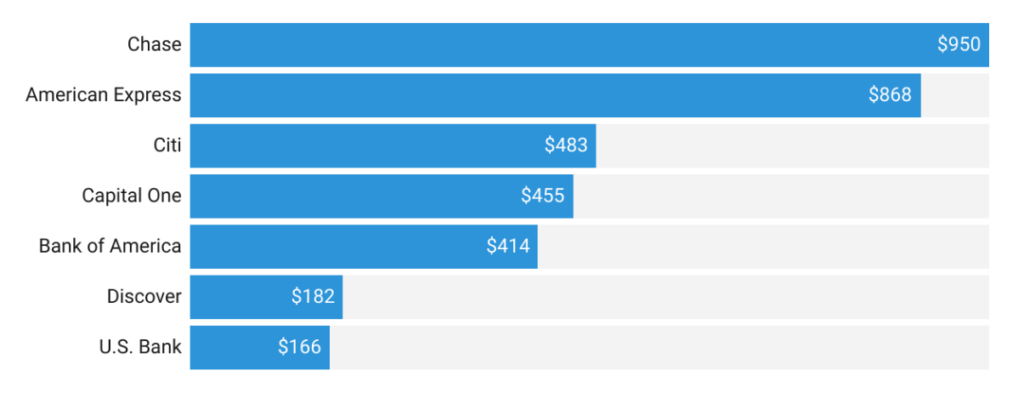

The graph mentioned above indicates that “Chase” is the top issuer of general-purpose credit cards in the US. However, Chase has issued approximately 149.3 million credit cards in 2023.

Certain debit cards issue both domestic bank pins and international scheme logos like Visa to enable out-of-country use.

Those dual-badged cards process on domestic debit rails when used locally, then leverage the financial standing network when crossing borders.

Regulations also impact processing. Charge cards carry greater fraud liability protections for consumers than debit.

Legislation can affect usage, like UK credit cards blocking gambling transactions.

So when debit mimics financial standing transaction flows, risk, and regulatory variations impact how/where the rails run – like alternate tracks serving different security and compliance needs.

When accepting charge cards adds an extra layer of convenience for customers, let’s be real – those processing fees can put a dent in business profits if not managed well.

The good news is there are some savvy strategies that can help tighten things up a bit.

First things first, take the time to choose a payment processor that’s a good fit for your business goals both now and down the road.

Work with someone who understands your needs and can tailor affordable pricing options based on your specific sales patterns.

Establishing this kind of collaborative relationship pays off in tailored solutions.

When setting terms, look for flexibility to qualify for lower interchange rates over time.

Milestones tied to sales volumes that are mutually beneficial for both parties help create reliable partnerships. This stability is a win-win.

Keeping up with changing consumer preferences means more opportunities to capture transactions.

Do You Know?:

According to a 2017 report by the Database Marketing Institute, payment cards spend an average of $80 in marketing and administrative costs.

Find a processor innovative enough to help navigate emerging options, so your business stays ahead of the curve.

Another savvy strategy is to offer occasional discounts for customers who pay with lower-cost options like cash or debit.

This slight incentive can impact payment choices in your favor by encouraging lower-fee selections at checkout.

Mastering the ins and outs of payment card processing allows merchants to optimize their payment flows and ultimately, maximize profits.

By demystifying key aspects like settlement timelines and fee mitigation strategies, more merchants can confidently accept cards as a preferred option by both customers and their own bottom lines.

With diligence and the right processor support, this complex backend machinery need not remain a mysterious black box slowing business growth.