Key Takeaways

- Quantum computing utilizes the principles of quantum mechanics to perform computations much faster than traditional computing systems.

- Quantum AI can revolutionize the field of finance by providing advanced computational capabilities and predictive modeling.

- Quantum AI algorithms can handle complex financial data sets with ease, enabling the identification of hidden patterns and correlations that traditional computing methods may overlook.

- The increased availability and accessibility of quantum computing hardware have opened up new possibilities for implementing Quantum AI in real-world scenarios.

- Financial planning involves analyzing vast amounts of data, identifying patterns and trends, and making informed predictions. The introduction of Quantum AI has access to a powerful tool that can process extensive financial data.

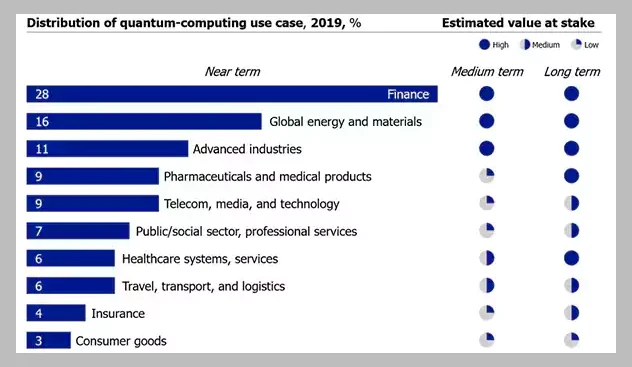

Quantum AI is revolutionizing various industries, and the financial sector is no exception. With its immense computational power and ability to process vast amounts of data, Quantum AI has emerged as a game-changer in financial planning and wealth management as vividly shown in the graph below.

In this article, we will explore the nuances and implications of Quantum AI in the finance industry, its benefits, real-world applications, as well as the potential challenges it poses and how they can be overcome.

To comprehend the significance of Quantum AI in financial planning and wealth management, it is pivotal to have a basic understanding of what Quantum AI is. Quantum AI refers to the amalgamation of quantum computing and artificial intelligence. Quantum computing utilizes the principles of quantum mechanics to perform computations much faster than traditional computing systems.

Artificial intelligence, on the other hand, enables machines to simulate intelligent behavior, process data, and make informed decisions. When combined, quantum computing and artificial intelligence create a powerful tool known as Quantum AI.

Quantum AI can revolutionize the field of finance by providing advanced computational capabilities and predictive modeling. It has the potential to optimize investment strategies, identify patterns in financial markets, and make real-time decisions based on complex data sets.

The integration of quantum computing and AI in financial planning can lead to more accurate risk assessments, improved portfolio management, and enhanced fraud detection.

Quantum AI can be defined as a computational approach that leverages quantum computing principles to enhance the capabilities of artificial intelligence algorithms. It utilizes quantum bits, or qubits, which have the unique property of being able to exist in multiple states simultaneously.

This parallelism enables Quantum AI systems to process vast amounts of data in parallel, resulting in significantly faster calculations and more accurate predictions.

Quantum AI algorithms can handle complex financial data sets with ease, enabling the identification of hidden patterns and correlations that traditional computing methods may overlook. By leveraging the power of quantum computing,

Quantum AI can provide more precise predictions and insights into market trends, enabling financial planners and wealth managers to make informed decisions.

Quantum AI has rapidly evolved over the years, with advancements in both quantum computing hardware and AI algorithms. Early experiments combining quantum computing and AI demonstrated the potential of Quantum AI. However, due to hardware limitations and the complexity of developing algorithms, practical applications were limited.

Recent years have witnessed significant breakthroughs in quantum computing technology and the development of specialized quantum AI algorithms. These advancements have overcome previous barriers, driving the adoption of Quantum AI in various domains, including finance.

The increased availability and accessibility of quantum computing hardware have opened up new possibilities for implementing Quantum AI in real-world scenarios.

Financial institutions and wealth management firms are increasingly exploring the potential of Quantum AI to gain a competitive edge in the market. By harnessing the power of quantum computing and AI, these organizations can improve their investment strategies, optimize risk management, and enhance customer experiences.

The evolution of Quantum AI continues to shape the future of finance, promising exciting opportunities and advancements in the field.

Do You Know: The Global quantum computing market had USD 89 Million value in 2019 and is speculated to grow to reach 949 Million by 2025.

The integration of Quantum AI in finance opens up a wide range of possibilities. Let’s explore how Quantum AI is revolutionizing financial planning and wealth management.

Quantum AI, a cutting-edge technology that combines principles of quantum mechanics and artificial intelligence, is making waves in the world of finance. With its unparalleled computational power, Quantum AI is transforming the way financial planning and wealth management are conducted.

Financial planning involves analyzing vast amounts of data, identifying patterns and trends, and making informed predictions. Traditionally, this process has been time-consuming and prone to human error. However, with the introduction of Quantum AI, financial planners now have access to a powerful tool that can process extensive financial data with lightning speed.

Quantum AI algorithms can identify hidden correlations and patterns that may not be obvious to traditional computing systems. By analyzing complex financial data sets, Quantum AI can uncover valuable insights that can inform investment decisions and optimize risk assessment strategies.

Imagine a financial planner using Quantum AI to analyze market trends, economic indicators, and historical data to predict future market movements. With its computational power,

Quantum AI can process and analyze these vast amounts of data in real time, providing financial planners with accurate and timely forecasts. This enables them to make more informed investment decisions and stay ahead of the curve in a fast-paced financial landscape.

Wealth management, on the other hand, involves effectively analyzing market trends, managing portfolios, and allocating assets to maximize returns for clients. Quantum AI is revolutionizing this process by offering enhanced predictive capabilities and improved risk management.

With its ability to process and analyze vast amounts of financial data, Quantum AI is a game-changer in wealth management. Market indicators, asset performance, and client preferences can all be analyzed by Quantum AI algorithms, enabling the generation of personalized investment strategies.

Imagine a wealth manager utilizing Quantum AI to create tailored investment portfolios for their clients. By analyzing the client’s financial goals, risk tolerance, and market conditions, Quantum AI can optimize portfolio allocations to maximize returns when minimizing risks. This level of personalized investment advice was previously unimaginable, but with Quantum AI, it is becoming a reality.

Furthermore, Quantum AI can proactively manage risks by continuously monitoring market conditions and adjusting portfolio allocations accordingly. This dynamic approach to risk management ensures that clients’ investments are always aligned with the ever-changing market landscape.

Ultimately, the integration of Quantum AI in wealth management contributes to better investment performance and client satisfaction. With its ability to process vast amounts of data and generate personalized strategies, Quantum AI is transforming the way wealth managers operate and helping clients achieve their financial goals.

Quantum AI offers several advantages that benefit the financial sector as a whole. Let’s delve into these benefits:

With its ability to process vast amounts of data and identify complex patterns, Quantum AI significantly improves predictive capabilities in the financial sector. By analyzing historical market data and current trends, Quantum AI algorithms can make more accurate predictions regarding market movements, asset valuations, and investment opportunities.

This empowers financial professionals to make well-informed decisions and maximize investment returns.

Risk management is a critical aspect of financial planning and wealth management. Quantum AI enables more accurate risk assessment by considering multiple variables simultaneously.

By analyzing historical data, market conditions, and various other factors, Quantum AI algorithms can identify potential risks and suggest mitigation strategies. This facilitates more effective risk management and provides investors with greater confidence in their investment decisions.

The impact of Quantum AI in finance extends beyond theoretical concepts. There are already several real-world applications where Quantum AI is making a tangible difference. Let’s explore some of these applications:

One notable case study involves a financial planning firm that integrated Quantum AI into its investment strategies. By analyzing vast datasets and leveraging Quantum AI algorithms, the firm achieved higher accuracy in predicting market trends and asset performance.

This paved the way for better investment decisions, resulting in increased profitability for their clients.

In the realm of wealth management, Quantum AI has shown promising results. Wealth management firms that integrated Quantum AI into their processes experienced improved portfolio optimization and risk management.

By leveraging the power of Quantum AI, these firms were able to generate personalized investment strategies tailored to their client’s unique preferences and risk appetite.

While Quantum AI presents significant opportunities in the financial sector, it also poses a few challenges. Let’s explore some of these challenges and potential solutions:

With the ability to process vast amounts of data, Quantum AI raises concerns regarding data security and privacy. As financial institutions adopt Quantum AI, it is pivotal to ensure robust encryption mechanisms and stringent data protection protocols. Implementing quantum-resistant encryption algorithms and adopting strict data privacy measures can help address these concerns.

Adopting Quantum AI in financial planning and wealth management requires a strong understanding of both quantum computing and artificial intelligence. Overcoming the learning curve associated with these technologies can be a challenge for finance professionals.

Offering training programs, collaborating with experts, and fostering a culture of continuous learning are some effective solutions to bridge the knowledge gap.

In conclusion, Quantum AI is revolutionizing financial planning and wealth management by offering enhanced predictive capabilities, improved risk management, and personalized investment strategies.

With its real-world applications already showcasing its potential, financial institutions must actively explore and embrace Quantum AI to stay ahead in a competitive landscape. While challenges such as data security and the learning curve need to be addressed, the benefits of Quantum AI in the financial sector make it a technology worth embracing.