Thanks to the Apple Pay service, you can make purchases without the direct use of bank cards, you only need a gadget (iPhone, Apple Watch, or iPad). The service is easy to use, and the level of security when making a transaction is considered the highest.

Key Takeaways

- The Apple Pay payment system allows fingerprint or password protection to keep your funds safe.

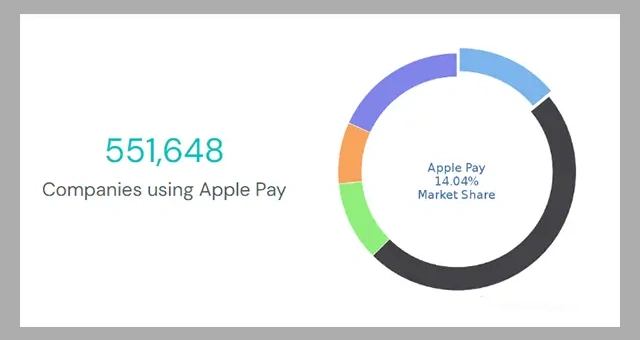

- In the online payment market, Apple Pay shares almost 14% globally.

- More than 40,000 stores and businesses in the USA accept Apple Pay.

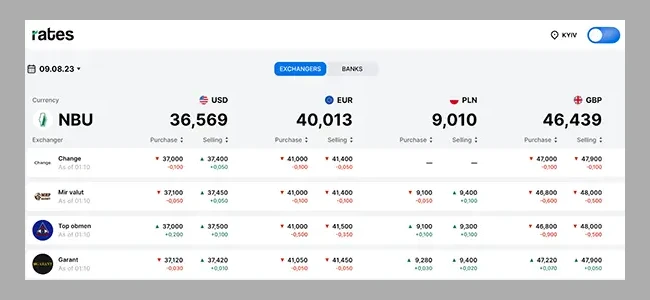

This is due to the fact that the card data is inaccessible to attackers since it is not stored in the smartphone and is not sent to the supplier upon purchase. In this article, you will learn about the advantages and disadvantages of using Apple Pay. You can also improve your financial control with https://rates.fm.

As of 2023, there are over 1.46 billion iPhone users worldwide. If you are an iPhone owner, then you are probably interested in learning about the possible ways to pay for services or goods using a smartphone. Let’s look at the pros and cons of using the most popular solution – Apple Pay.

The process of purchasing goods becomes fast and comfortable with Apple Pay. Instead of a plastic card or cash, a mobile device has come. Payment takes place at the moment when the buyer touches the terminal with a smartphone. After a few seconds, the screen lights up, which indicates a proposal to perform the operation.

In the global market, Apple Pay has been able to capture the 14% of the audience that pays online for their stuff.

To agree, you must present your finger to the fingerprint scanner or use a password. Payment is confirmed immediately. This is confirmed by a notification about the successful completion of the transaction.

Not all outlets are equipped with an adaptive system. In order to determine the possibility of using the phone, you need to pay attention to the terminal. If it supports contactless payment, you will see a special sign on it that indicates the availability of the service.

Apple Pay protection is multi-layered:

In tandem, all elements are designed to ensure the security of finances and personal data, which is more reliable than a magnetic stripe and a chip on a banking product. Unlike phones with the Android operating system, the iPhone is initially equipped with the Wallet application, which is a repository of Visa or Mastercard bank cards.

In the application, you need to find the item to add a map. If a credit card was previously used in iTunes, the system will automatically prompt the user to add it. If this is not the case, then you can scan the data from the card or enter it yourself. Further, the bank confirms the application by means of an SMS notification or a call.

Apple Pay interacts with bank and reward cards, it is possible to connect up to 8 pcs. The user can transfer funds to other owners, provided that they also have this service installed.

Using an iPhone to pay for services or goods has its pros and cons. But if you follow the safety rules and use them correctly, paying by phone can be very convenient and safe. Let’s look at the advantages and disadvantages of Apple Pay in more detail.

Apple Pay uses a specially created data exchange protocol between payment participants. The system is built on multi-level protection:

Taken together, these conditions protect your funds more reliably than a chip and a magnetic stripe on a bank card. When devices connect, one-time unique tokens are created. They are deleted immediately after the payment is made.

The token replaces the card number, which is encrypted using a special system. It is almost impossible to decrypt it. Apple Pay’s security system is similar to the security of cryptocurrencies, in particular Bitcoin. Apple Pay is freely used by clients of giant companies such as Binance, Aetna, Wells Fargo & Company, and others.

Using Apple Pay on the iPhone is a smart and secure choice for making purchases. Due to the high level of security and ease of use, the service is popular among Apple users. If you want to improve the experience of using Apple Pay, we recommend using the Rates service to track the exchange rate (dollars, euros, etc.) in different Ukrainian financial institutions. You can access the service at any time of the day from any US city, be it Chicago (Illinois) or Houston (Texas).