Key Takeaways

- Equipment Bill of Sale is a deal between the buyer and the seller and proof that the transactions have taken place.

- The equipment lease agreement is a contractual agreement between the owner and the renter.

- There are various criteria to look out for before you sign any of these agreements. Knowing the difference between them is significant to make an informed decision while making a transaction.

In the realm of managing equipment transactions, two vital documents often come under consideration – the Equipment Bill of Sale and the Equipment Lease Agreement. But how do these two documents differ?

Understanding these differences is significant to ensure a smooth and lawful tools transaction process.

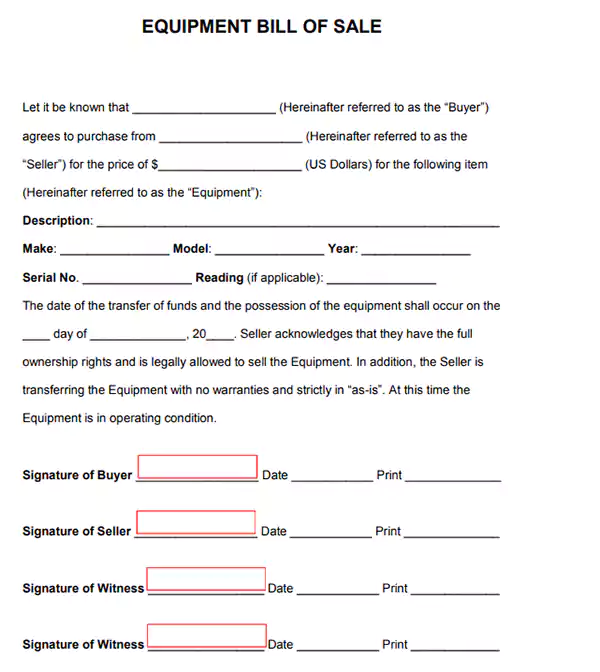

It is a legally binding document that proves the transfer of ownership of apparatus from the seller to the buyer.

This bill exists to protect both the buyer and seller, validating that the deal has legally taken place and outlining any warranties or guarantees.

Key elements in a standard bill of sale form for equipment commonly include:

Because it establishes a clear transfer of ownership, it provides legal protection for both parties involved and can act as a receipt for the transaction.

However, there are certain things to keep in mind before agreeing to purchase. Cross-check the serial number with the manufacturer to check for its authenticity and also verify that you are purchasing from the actual owner. This can be backed up by asking for the purchase receipt.

After you are done with establishing the authenticity of the item, the next step is to check it’s working. You can also hire any expert for a careful and proper inspection.

Lastly, scrutinize the details mentioned in the equipment bill of sale such as the name of buyer and seller, date of transfer, year, model, etc.

Do You Know? A few examples of the things that are included in this form are entertainment (musical instruments, sound systems, etc.), Kitchen tools (knives, cookware, appliances), office tools (projectors, computers, printers), and home equipment (ladders, television set, lawnmowers).

On the other side of the coin, this grants someone the right to use an article for a specific period, rather than outright owning it. This can also be called a contractual agreement where the owner allows the renter to use the item for a particular period and in exchange the renter makes periodic payments.

Numerous types of equipment such as furniture, vehicles, factory machines, computers, and printers can be taken up on lease.

It’s akin to renting, but usually over a long-term basis, often to accommodate business needs.

Key typical elements included within this agreement include:

This type of agreement is usually used by companies who lack the budget to buy large and expensive machines. Some high-technology tools can cost up to millions, so to save up money they rather decide to rent them for a specific period.

There are many benefits to renting items via equipment lease. The foremost is that you can upgrade your machines anytime to a more advanced one. This will help you to stay ahead in the market. Purchasing and selling the articles can cost you a lot. Renting will ensure that you can switch to more advanced technology.

Besides, Equipment lease agreements sometimes offer tax credits. This will help you to deduct payments as a business expense.

However, some terms form the base of a contract that plays a chief role in the whole process. Some of them are listed below

On the other hand big companies or organizations looking for expensive equipment lease for longer duration.

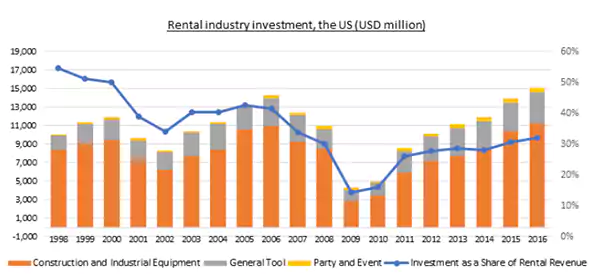

The below graph represents the breakdown of various industries renting items for different purposes from 1996-2016.

While both documents are paramount for the transactions, their uses, and implications differ.

An equipment bill of sale secures the outright transaction of the article, transferring ownership immediately from the seller to the buyer. The buyer becomes liable for the care, damages, repairs, and anything else that occurs to it.

In contrast, an equipment lease agreement allows for prolonged use of the articles without transfer of ownership. The lessee simply pays for usage, with the lessor remaining the true owner.

Maintenance and repair responsibilities can be contracted out, either to the lessee or kept with the lessor. These contracts often incorporate options for purchase once the tenure period expires.

The decision between a bill of sale or a lease agreement will depend on:

Knowing the differences between both of these agreements can guide you in making informed decisions in equipment transactions.

No matter whether you need an outright purchase with an equipment invoice of sale or flexible usage with an equipment lease agreement depends on your individual or business needs.

Always consider financial conditions, duration needs, maintenance responsibilities, and future considerations when deciding to buy or lease articles.