Have you ever noticed how quickly our world is evolving right now? It is impossible to ignore the advancement in technology. This trend of modern startups and new businesses holds great credit for this tech revolution. A prominent example of this revolution can be none other than, Bitcoin. Bitcoin idealizes the future for many new ventures. Who would have thought that there can be an intangible and completely-digital payment and investment method? Moreover, these startups give opportunities to other businesses as well. For example, with the sudden boom in the trend of blockchain technologies or crypto-currencies, many netizens visit platforms to learn how to buy Bitcoin and how to trade in cryptocurrencies.

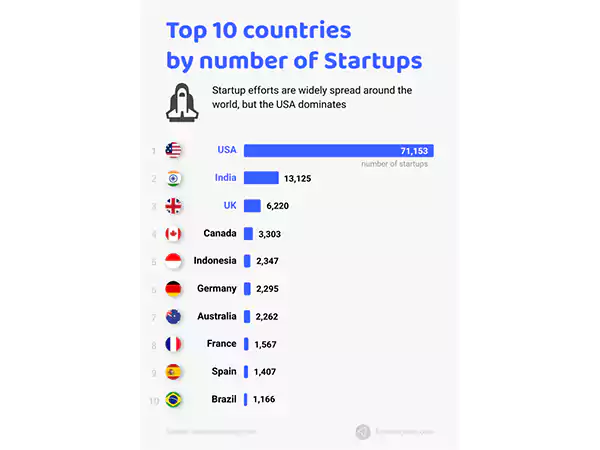

According to research done by Startup Ranking, the USA leads the startup trend in the world with the most active institutions, followed by India and UK.

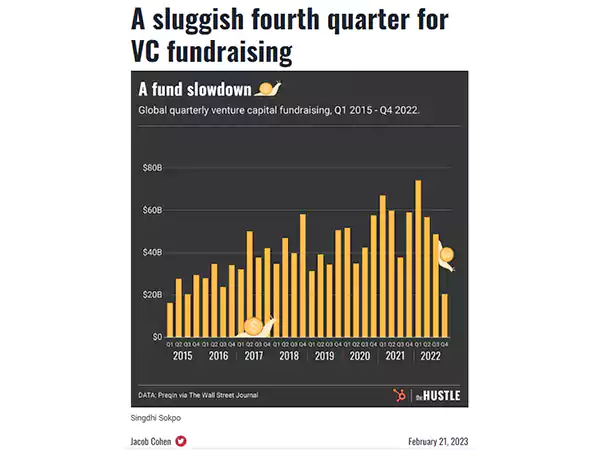

The most crucial element for these new ventures is their funding. Funding for Startups is like the blood of the human body. Funds allow them to circulate daily operations and deal to perform smooth functioning.

These institutions are sometimes funded by some banks. Banks like Silicon Valley Bank, emphasize funding startups. But how are these banks different from other banks? We will discuss this in the next section.

Silicon Valley Bank was founded in 1983 in Santa Carla, California. Banks like SVB are more flexible to lend money to new ventures as the majority of the account holders in the bank were venture-capitalist and investors. However, the SVB eventually fell on March 10, 2023. Prior to the fiasco, it was a go-to option for ventures for raising the funds.

The bank got so big that it made the list of America’s Greatest banks and held the 16th rank before its collapse. The portfolio of SVB had a number of popular and influential institutions. Some of their biggest clients are:

Moving on with the article, we will discuss the reason and causes of how the bank caved in.

In this section of the article, we will roughly discuss the elements that crumbled the whole bank and its functioning.

This generated panic among the account holders and gradually more and more holders started to withdraw their funds from the bank.

Because of this the startups were unable to carry out their operations and were losing their confidence. Venture capitalists and startups are correlated with each other, which caused a sudden fall in the fund collection of the bank.

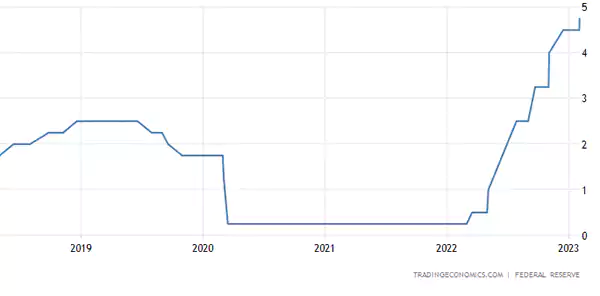

Since the loans are getting expensive, there has been a drop in the demand for loans. This fall in demand for loans led to difficult money-making for the banks.

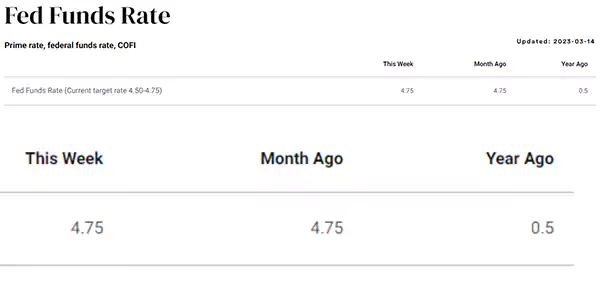

As you can see in the picture, the interest rate has touched the sky from 0.5% to 4.75% in just a year. Therefore, lesser people are claiming loans and banks are unable to multiply their money.

These were the main contributors to the episode that led to the fall of Silicon Valley Bank. Before this event happen, the bank was ranked as the 16th biggest bank in the United States of America. Further, we will discuss the aftermath that can be caused by this demise of the bank.

According to the experts, the fall of Silicon Valley Bank will affect not only the startups linked with it but also a major chunk of the population that is associated with those startups.

Some of the aftermaths that can occur from this event are:

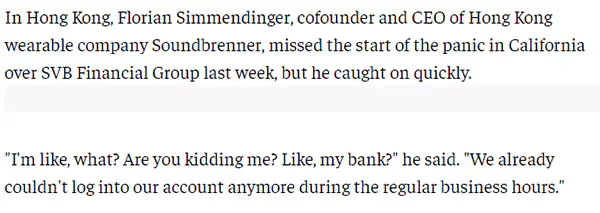

Many Venture-capitalist and startups’ money got stuck in the bank. Florian Simmendinger, founder and CEO of Soundbrenner, showed their frustration about this issue in recent times.

“I think either California or the Treasury Department should backstop Silicon Valley Bank – thousands of companies will fold or lay people off next week because of lack of access to accounts through no fault of their own,” ~ Yang thinks.

Silicon Valley alone has resulted in a major drop in the stock market around the globe. For example, Indian Nifty Bank Index suffered by 850 points on the same day of March 10, 2023. As of this fall, one of India’s major banks PNB (Punjab National Bank) came down by around 2.6%.

Just like Silicon Valley Bank, the account holders of the Signature Banks also started withdrawing their deposits due to the high amount of uninsured deposits and exposure to crypto lending. To avoid another fall of the giant, New York’s Community Bank has decided to buy a large chunk of the Signature Bank.

In the end, we can get to the conclusion that no matter how big or rich an organization is, if not managed perfectly, the fallout is confirmed.

Moreover, it is not only SVB’s concern. There are Investment Research firms like Hindenburg that could have predicted this event if they worked the right way. Hindenburg was primarily active a few months back about some foreign issues but they could have prioritized more on domestic issues.

Building a startup or investing in a startup is a risky and courageous task. Their hard-earned money should be respected and should be kept safe as their first priority.