Key Takeaways

- Coverage, payment claims, and accessibility are the three major things to consider when choosing homeowner insurance.

- Before going to finalize an insurance deal, determine what things you need to protect and what needs to be covered under the insurance.

- You can always compare quotations from different insurance companies and go for the right one.

- Check the ratings and reviews of different insurance alternatives and find the one that suits all your needs.

Buying or building a home is a huge investment, and it doesn’t make sense not to have any sort of protection to keep it safe and secure. Homeowners insurance is designed to help property owners safeguard their home and their personal belongings, as well as the people in their space.

Most policies already cover some basics, but it’s best to figure out what you need early on and choose the right coverage for your needs.

There are three major factors to consider when choosing homeowners insurance: coverage, payments and claims, and accessibility. Each aspect holds its value and significance behind it.

Any misconception in these aspects can lead to various arguments and can even make you unable to claim the insurance in case anything bad happens to your property. Therefore, without wasting any time further, let’s break down each one.

Homeowner insurance is so vital in case of an emergency that in 2020, out of 100%, 97% of the insurance claims were made out of property damage. ~ Insurance Information Institute, Triple-I.

Your homeowners’ insurance coverage will determine the extent of protection your insurance provider can give you in the event of a claim. Whereas a basic homeowner’s insurance policy is a good starting point, you might want to extend your policy with additional coverages.

Especially if your home is located somewhere more prone to certain non-included damages (like floods or earthquakes) or have belongings that require extra protection (such as valuable possessions).

Check how an insurance provider structures their payment plans and if they’re amenable to you. Some require monthly payments, but if you’d rather pay more infrequently (e.g., bi-annually, annually, etc.), you’ll need to look for options that will allow you to do that.

You also want to take a look at how the insurance provider processes claims. When damages occur, you’ll want your insurance company to have you back ASAP.

Your insurance provider, or at least your insurance agent, should be accessible to you at all times. That way, when something unexpected happens, you can reach out to them immediately. It’s best to get a homeowners’ insurance policy from a provider in your area or from a large company with satellite offices catering to where you are.

After various considerations that you just read in the previous section, here are some tips to help you choose the right homeowners’ insurance for you. Consider noting all of them to get the best deal that respects your needs and also the money in your account.

When it comes to damage coverage, they come in several categories. Many of them will not be even needed by you. Paying for those coverages might ultimately prove to be a waste of funds.

Therefore, make sure you only pay for the coverage you require. To do this, you need to know what and how much you want to project in the first place. Consider your home’s location, features, etc. to determine the best plan for you.

Every service provider or insurance company provides their clients with a quotation that includes all the information regarding payments, intervals, and other terms and conditions.

It is advised to always compare quotations from multiple insurance providers. Many offer the same things at different prices, whereas others have extras tacked on for an even better deal.

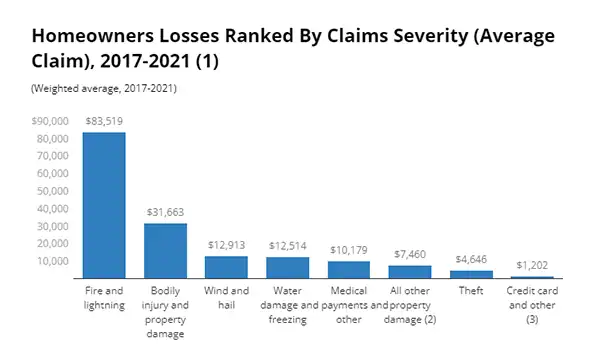

Out of all the amounts claimed for types of losses that occurred to insured homeowners, Fire and Lightning stay at the top of reasons for the cause.

As you can see, an average of more than $83,000 of loss was incurred by homeowners between 2017-2021.

There are various experiences to refer to online. You can check out various websites to search for the best of them. YouTube videos, social media platforms like Facebook, and several websites can serve you with the purpose.

Refer to ratings and reviews to vet homeowners insurance offers and the quality of service of different providers. It’s good to read through feedback from actual clients, versus just relying on curated testimonials.

Houses and property are one of the biggest investments that a human makes for himself and his family. Therefore, these are the tips and strategies that you must know before opting for the right insurance policy for your property. One thing to not forget here is that you should always explore as many options as you can. You never know what policy will work out for you.

You must keep all your belongings safe and sound. Choosing the right homeowners’ insurance is the best way to ensure that you are thoroughly protecting your home, your belongings, and the people you love. Properly sorting and vetting your options will also help you get the most bang for your buck!