The world of crypto can be chaotic, with cryptocurrency prices going up one second and down the next.

And, aside from Bitcoin, only a few other players like Ethereum and Solana have made an impact on the whole of the crypto community for holders, miners, and investors alike.

But, if you ask me, Ethereum is one of the major players in the crypto market.

Besides, with the recent merge, Ethereum has moved from the Proof of Work (PoW) model to a Proof of Stake (PoS) model.

This has brought in some pretty huge changes in the Ethereum price market.

Plus, this merge is also set to have some pretty huge implications for ESG.

ESG basically stands for environmental, social, and governance.

They are kind of like the set of standards that measure the impact a business has on society as well as on the environment, as well as how transparently it operates.

You know, by adopting ESG practices in their investment practices, investors can also avoid putting their money in companies that are engaged in risky or unethical practices too.

When you look at the larger picture, the importance of ESG compliance is much more significant.

DID YOU KNOW?

As of November 2023, Ethereum’s ESG score is 78, which is higher than other cryptocurrencies. And, as of today, the Ethereum network has reduced its energy consumption by up to 99%.

Well, the concept behind ESG investing pretty much centers on how the stakeholders and management make their decisions.

It also has a lot of steps involved, like screening the companies based on specific factors related to sustainability.

Besides, sustainable investment affects more than just the decision-making process.

And with the rise of decentralized finance platforms, it has become even harder for investors to pick a good ESG asset to invest.

It takes into account all the real-world impacts those decisions will have on a global scale.

Ethereum’s commitment to ESG sets the stage for a positive change in the world of digital finance.

You know, even with all the challenges the world is facing, like climate change and resource scarcity, it still manages to reduce the impact it has on the environment by a lot.

The ether network has moved on from Bitcoin’s old energy-intensive proof-of-work to a new and more eco-friendly proof-of-stake model.

This means that the whole Ethereum network has managed to pretty much reduce its energy consumption and carbon emissions from when it was run on a PoW model.

Since the network runs on a decentralized blockchain, it has pretty much reduced the need for any middlemen or a central authority to control it.

This means that people and communities using this network will have more control over their financial resources and information.

This model pretty much guarantees that anyone, anywhere, can have access to its financial services, irrespective of their background.

This decentralized approach shouts social responsibility while also being inclusive and easily accessible to all different kinds of people.

And, with this inclusion, even people living in the countryside can have access to some basic banking services on its network with a simple smartphone and an internet connection.

Plus, crypto smart contracts in the ETH network also allow its users to have access to financial services like lending and trading.

Good governance can pretty much ensure transparency, accountability, and responsibility in making decisions in any system.

And, as Ether is community-driven, this means that its investors and hodlers will have a say in the future direction and development of the platform.

This approach literally embodies the “G” in ESG.

This means that Ethereum users and investors have a say in the network’s rules and protocols.

Simply speaking, this allows Ether to remain adaptable and responsive to evolving challenges while still keeping its integrity and good governance principles.

As I’ve stated before, since Ether merged its 2.0 network and moved to a PoS model, Ethereum has seen a pretty steep rise in its price.

And with more and more investors adopting ESG principles into their investment strategies, the prices for Ether and other similar cryptocurrencies will only keep rising.

Today, more and more investors are mixing in ESG principles into their investment practices.

These ESG-conscious investors are always on the lookout for sustainable and socially responsible investment options.

Besides, as more investors prioritize ethical considerations in their financial gains, the integration of ESG into their investment decisions will continue to gain more popularity in the crypto space.

In the future, if the blockchain focuses more on ESG, it can very easily improve its transparency and accountability in its processes.

This means that with blockchain, we can make the ESG data of a company more tamperproof, which can pretty much ensure the authenticity and reliability of this data for investors.

Plus, as blockchain is decentralized, it can change how ESG reporting is done by giving investors a platform that is not under any central authority.

This means that there will be no chances for data manipulation, and it can be a pretty secure way of tracking environmental impact, social responsibility, and governance practices for a company.

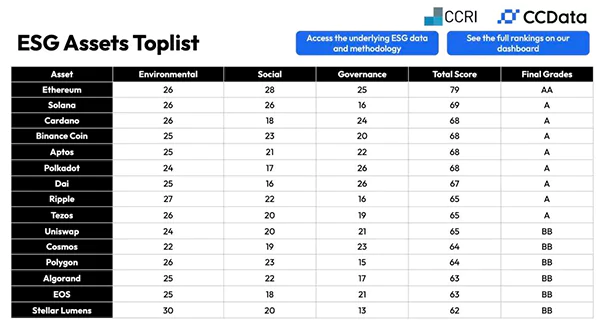

Ethereum topped the first institutional-grade crypto ESG ranking, followed by Solana and Cardano, while Bitcoin lagged due to its heavy energy usage, according to crypto data firm CCData’s research.

CCData’s inaugural ESG Benchmark, created in unison with the Crypto Carbon Ratings Institute (CCRI), was published on July 8th, 2023. It evaluated 40 of the largest, most liquid digital assets, assessing parameters such as decentralization, security, and climate impact.

In the chaotic world of cryptocurrency, ETH has come out on top as one of the most ESG-centric assets in 2024.

And, by merging its 2.0 network with the old one and moving on to a proof-of-stake model, Ethereum has managed to reduce its energy consumption and carbon emissions by more than 90%.

But still, the impact of adopting good ESG practices in the Ethereum network with its market price is pretty complex.

The investor’s adoption of ESG principles into their investment practices directly affects the demand for ETH.

We need to look more into the concept behind blockchain technologies to get ideas on how to align investor objectives with modern ESG principles.