KEY TAKEAWAYS

- Day trading requires your focus daily and needs quick decisions.

- Swing trading suits long-term strategies, offering flexibility for less frequent but thoughtful trades.

- Day trading minimizes exposure, while swing trading risks external market changes.

- Your time availability determines strategy.

- Both methods can be profitable, but you have to keep your goals and lifestyle in consideration.

A study in 2023 by Pew Research showed that 28% of U.S. adults have ever invested in cryptocurrency, which highlights its increasing role in modern finance. During surges in market activity, instances of trading activity on various platforms

Within the different strategies of crypto, day trading and swing trading are two of the more common strategies used. Both aim to take advantage of price changes and realize a profit, however, these two strategies differ in the levels of time and risk involved, as well as the skill required to be successful.

In this article, we will go over the definition of each strategy (day trading and swing trading), the advantages and disadvantages of the two strategies, and whether one has an advantage over the other or if one is a better fit for you.

Day trading involves buying a digital asset and selling it on the same day. Many traders follow crypto market trends to help guide their investing decisions. They will have a keen eye for the best cheap crypto to buy now, and purchase it at these low prices.

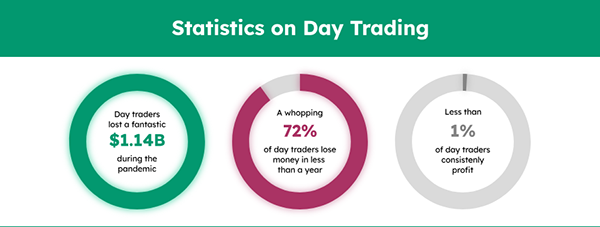

Many cheaper coins are highly volatile, meaning crypto values often rise and fall quickly. This means that those using the day trading method to sell their purchased crypto on the same day can typically benefit from the constantly changing conditions of the market and make a profit by doing so. Below you can see some statistics related to day trading.

Swing trading is, in many ways, the complete opposite of day trading. It involves investing in crypto and holding the asset for days, weeks, or months. The idea here is that investors can take more time to analyze market trends to find the optimal time to sell the assets for the highest price.

Many investors who actively participate in swing trading use crypto market analysis and behavioral indicator tools, such as crypto websites and MACD crypto indicators, to help them determine when the best time to sell is.

As with many things, the answer to this is based on the individual and their goals when it comes to crypto investing. Both strategies have pros and cons, but each has proven to be profitable.

Instead, there are several factors that financiers should keep in mind before deciding between the two. These include:

To make a significant profit out of day trading, investors would need to dedicate a lot of attention to it. Many strategies should be learnt and incorporated into the trading every single day. This works for those pursuing crypto careers, but not for people with other commitments.

As such, swing trading, which does not require as much spare time daily, may be more suitable to those who see crypto trading more as a side hustle or pastime that can earn them a little extra cash.

Day trading and swing trading are two very different kinds of environments, tailored to two very different kinds of personalities and mindsets. People who like fast-paced, high-risk activities often enjoy the thrill of day trading.

The gains can become visible quickly, and concentration is key when it comes to this kind of strategy. Swing trading offers a calmer setting, appealing to those with a steady long-term focus.

Whether an investor is better suited for day trading or swing trading typically depends on how much time they can dedicate to trading. To make the most out of day trading, investors need to be able to dedicate a considerable amount of time daily to monitoring the market and making decisions under pressure.

That being said, swing trading is a much more suitable option for those who can’t dedicate as much time every day to crypto trading, but can sustain small scheduling conflicts over a long period.

It can be helpful to think of this as the classic tale about the tortoise and the hare, with the hare reflecting day traders’ quick and immediate responses to the market. The tortoise symbolizes swing trading’s slow and steady method.

Finally, one of the key factors in deciding if a trader is better suited for day trading or swing trading is the individual’s risk tolerance. There is much more risk involved when it comes to swing trading because investors often wait days or weeks before selling their assets, and thus leave them exposed to many external factors that could affect their price.

This is much less likely in day trading, where digital materials are rarely even kept overnight, and so little time is permitted for big events to drastically impact the value of the currency.

It’s impossible to say, objectively, whether day trading or swing trading is more advantageous when it comes to trading crypto. Both are suited to different individuals who will hold different priorities.

Those suited to the fast-paced nature of day trading and able to commit the required time definitely should. But those who wish to trade more casually and are looking to dedicate a small amount of effort over a longer period might be better suited for swing trading.

Day trading requires a focus on an individual stock and fast results in a single day, while swing trading takes the approach of less frequent monitoring over many days/weeks.

Day trading would be better for a low-risk trader because it has limited overnight exposure as opposed to swing position trades.

Traders who enjoy fast-paced excitement and need to alter strategy/trade directions prefer day trading; those who prefer a more consistent focus that works in their everyday routine lean to swing trading.