Artificial intelligence has penetrated almost every industry. It is exceptionally good at handling data. Finance, being a very data-heavy sector, made it a natural fit for AI integration.

Even experts take a lot of time in manual financial planning because the consequences of a bad decision can dent the capital. IBM 2025 data says that 91% of asset managers plan to or have already integrated AI for research and portfolio management.

With machine learning, the process has become a lot faster, and the error rate is also reduced. You can make much better financial decisions with predictive analytics.

In this article, I’ll explain everything about financial forecasting, what AI brings to the finance sector, its key uses, benefits, and best practices around implementation.

KEY TAKEAWAYS

- Predictive finance analytics improve financial decision-making.

- It enables outcome forecasting and risk minimization in areas like fraud detection, lending, and compliance.

- The result is better efficiency and risk management, reducing costs and losses.

- Implement with clear goals, quality data, and humans in the loop.

Finance firms are spending huge amounts on custom AI software development to improve the efficiency of various workflows. One of them is forecasting analytics.

It takes historical data and puts it into a statistical algorithm to forecast future trends, risks, and performance.

The core technologies leveraged by these systems are artificial intelligence, machine learning (ML), and data mining.

Finance professionals are empowered by these systems as they make a shift from reactive to proactive decision-making.

The major use cases of finance AI are:

All this leads to improved budget planning and compliance.

Artificial intelligence is transforming how financial decision-making is being done. The activity has turned proactive from reactive. The data has shifted from the spreadsheet cells to be analyzed entirely in an organic manner.

Integration of technologies such as ML, NLP (natural language processing), and predictive analytics has enhanced the accuracy and speed of data modeling, forecasting, and risk assessment.

The data modeling is no longer about manual inputs and static formulas. It is more dynamic. The models have become adaptive, updating in real time.

The forecasting used to happen periodically, i.e., monthly or quarterly. Now, it’s a continuous process. You can look at the future and instantly pivot the strategy as you deem fit.

We have moved past risk management. Now it’s just risk prevention as risks are identified, assessed, and monitored in real-time.

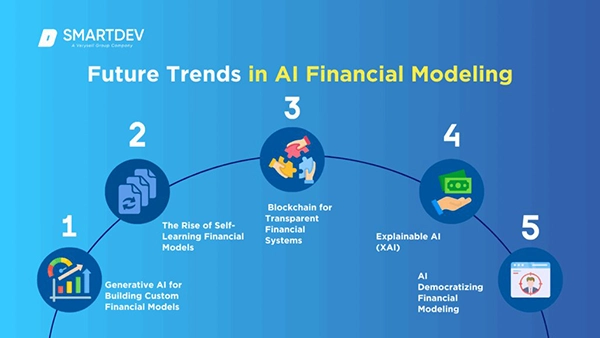

The future of finance AI is even crazier, as depicted in the following infographic:

The top use cases of artificial intelligence in financial analytics are:

Employing AI in financial planning benefits you in multiple ways:

Integrating machine learning into your financial planning and implementing a robust predictive model requires:

Now you know how AI integrates into the finance world.

It helps us make significantly better decisions around finances, enabling outcome forecasting and risk minimization. The use cases span across areas like fraud detection, lending, and compliance.

It improves the financial workflow efficiency, reducing the costs in the process. Risk is also better managed as it optimizes the portfolio.

Just keep the goals clear, use quality data, and don’t remove human oversight altogether.

Faster and smarter finances with AI!

Artificial intelligence has enabled predictive finance analytics, improving financial decision-making. Also, better portfolio management and risk management have improved operational efficiency and reduced costs and losses.

Forecasting, fraud detection, creditworthiness assessment, algorithmic trading, document processing, and finance advisor chatbots, along with automation of operations, reporting, and compliance.

Keep implementation goals clear, use accurate, complete, and masked/anonymized data, regularly update models with updated data, and keep humans in the loop for accountable and ethical decision-making.