Nowadays, almost every company provides medical benefits to its employees in the form of medical insurance. Health insurance is one of the important factors that employees consider before joining any company.

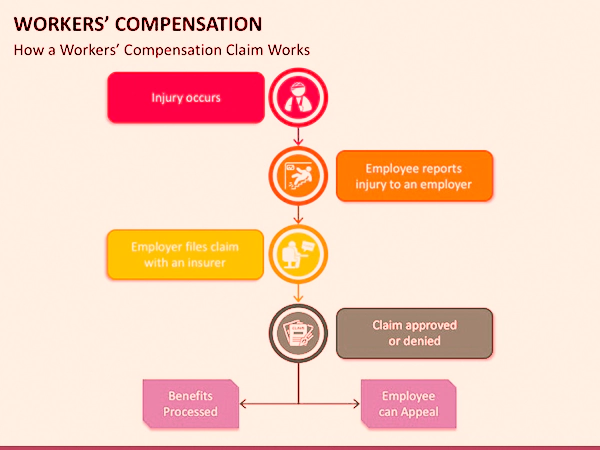

Taking this into consideration, the government has announced a worker’s compensation scheme, which acts as a protective shield for workers.

It covers medical care and wage replacement for workers who suffer job-related injuries.

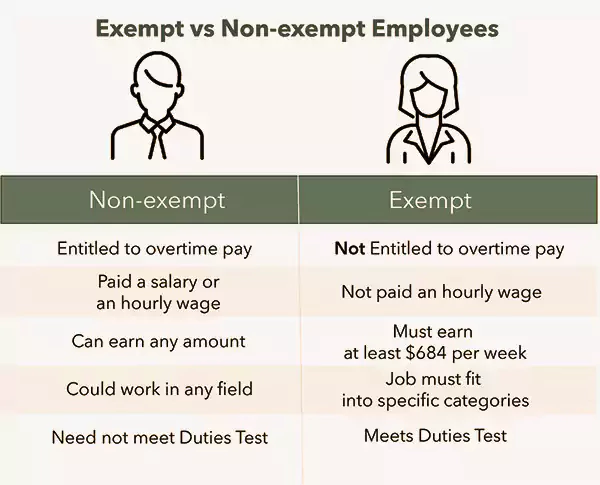

However, this wonderful scheme was exploited, as some fraudsters tried to take the benefits by presenting false medical reports. The government has created a Worker’s Compensation Exemption, under which employees won’t get benefits from medical injuries that they get during work.

Before claiming compensation, it is mandatory for an employee to show workers compensation certificate, reports and risk factors to the company.

Every year, the government releases workers’ compensation reports and statistics under the Department of Labor.

It refers to both people and businesses that don’t have to provide any medical compensation to their employees. Generally, workers’ compensation protects the employee’s unwanted medical expenses and the business from getting sued.

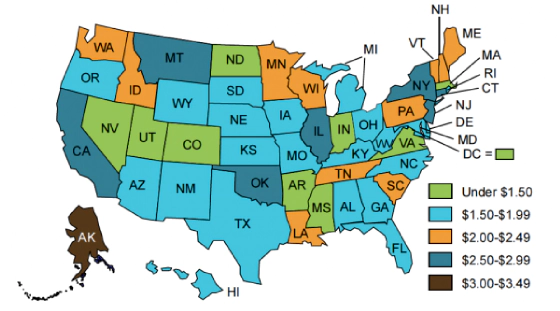

It is always a good idea to double-check our state’s criteria for workers’ compensation. In fact, you can consult the state workers’ compensation division or even an insurance agent.

Being an independent contractor, a solo entrepreneur, or a business partner are all popular reasons for being free from workers’ compensation insurance.

However, some other groups may qualify for the scheme, too, making it essential for you to determine whether you are qualified for the compensation or not.

Here is a list of possible contenders who may qualify:

That’s the end of a long list of profiles that may come under the exemption. We hope that you understand that each job profile and profession is unique, and as a result, they might have a different policy on the same medical claim.

Also Read: Wrongful Death Claims in Motorcycle Accidents

Despite the list, each state has its own laws for workers’ compensation exemptions. It is imperative to know your state’s unique laws about the policy for a better understanding.

Some states where you need a government contract: Texas and South Dakota

Other states by the minimum number of employees:

Employee(3+): North Carolina, Georgia, New Mexico, Arkansas, Wisconsin, Virginia

Employees(4+): South Carolina, Florida

Employees(5+): Mississippi, Alabama, Missouri, Tennessee

Here’s a quick list:

Ventilation, Concrete, Heating, Air-conditioning, and Tree trimming

Only three officers or members of a construction company might be free from workers’ compensation.

Here are some quick step guides by which you can get a worker’s comp exemption. Note that there are dozens of online platforms that provide an insurance agent, but their extra fees can be avoided by doing some self-research. Just follow the steps and get a compensation exemption:

Your broker can give important guidance on the processes required to get a workers’ compensation exemption. He will advise you if you need to fill out a notice of election form and notify you of any extra information.

After filling out the exemption form, you have to hand it to the relevant body, which is usually your state’s division of workers’ compensation.

Some insurance companies are involved in the procedure and may charge a modest fee to handle the paperwork.

When your state’s division of workers’ compensation authorizes your exemption, they will offer you a certificate of election.

This certificate is crucial; therefore, keep it secure with your other critical business paperwork.

It’s up to you whether you want to take the worker’s compensation exemption or not. It is a personal decision that is influenced by considerations such as injury risks in your business.

The construction business is one of the most dangerous in terms of fatalities. Transportation and warehousing are second, while government contractors are third. Some workers even lost their lives during work, which makes it essential to implement.

Exemption from workers’ compensation insurance might save your company money in the long run. However, it is not business-friendly in the long run.