This past weekend, cryptocurrency values plunged again, with Bitcoin falling to its lowest level since December 2020. Similar price movements occurred only one month earlier.

After a weekend in which the crypto market lost more than $200 billion and the U.S. crypto lender Celsius Network halted all withdrawals, Bitcoin values have decreased by about 9 percent in the previous 24 hours to $20,500, or INR 16,00,530.

As BTC dipped below $33,000 this week for the first time in about a year while the ETH fell about 11% in one day and Cardano dropped 11.50% to $0.453698, the crypto market appeared to be collapsing, or at least through a significant correction.

Given the classic financial cliché “buy the dip,” investors may now be seeking a piece of the volatile cryptocurrency market in the hopes that the current fall is temporary and not indicative of a prolonged bear market (price falls).

If you believe that now is the time to purchase cryptocurrencies, or BTC, you have reached the right place. Here we are going to discuss Bitcoin’s current position in the market and the significant losses the industry is facing.

We will also explore whether buying the dip is a suitable strategy considering the current situation of the cryptocurrency and offer you some expert opinions and purchasing advice.

To learn more about how to buy or invest in Bitcoins with IBAN, follow the link: https://trastra.com/coins/sell-btc-for-iban/.

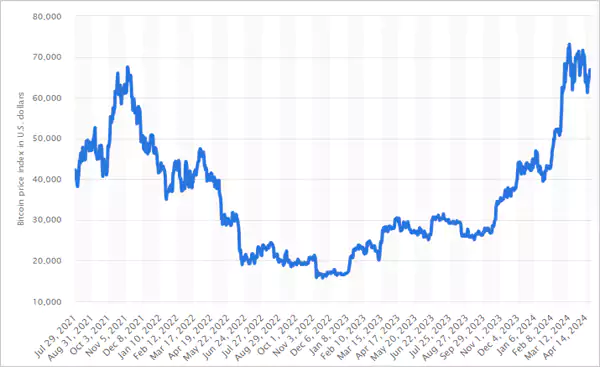

Bitcoin’s price has dropped 20% month-over-month to $32,000. It sold for $69,000 in November 2021, which shows a more than 50% drop that indicates major losses, as shown in the image below.

The above image shows Bitcoin’s position in the past few years.

While this might not seem as bad as it was in 2018, when Bitcoin lost 80% of its value, many traders fear it might get worse.

Considering the possibility of these casualties, the Reserve Bank of India, India’s financial regulator, has warned crypto investors about these losses. In their warning, it said that there are no return guarantees on trading, therefore investors should be prepared to lose everything.

More than these losses, there is something bigger that we must remind you of before you start trading. Let’s look at those aspects in the later section.

Officials from reputable companies have said that crypto is undergoing the same economic stresses as other industries, causing a price drop.

“Everything is collapsing, and the next six to twelve months’ economic projection is dismal. Central banks face sluggish economic growth and rising inflation. Thus, investors are avoiding risky assets like cryptocurrency and tech stocks.”

According to them, the market might be tough for two years, but things could worsen at any time.

The concerning situation is that after plunging below $30,000, bitcoin is nearing the brink of a major support level. If it falls below this support level, the future of the Bitcoin price might tumble below $25,000 before any action is taken.

Global markets have also suffered from this dip in price since June 2020 because of rising U.S. interest rates and European military tension.

Furthermore, last week’s RBI inflation statistics likely affected interest rates and eventually cryptocurrency prices.

Ultimately, the significant losses from the dip in price have led to inflation, economic decline, and military tension. So, if you want to entertain the thought of investing your money in BTC, we recommend you consider these losses. Now, let’s take a look at whether you should consider buying the dip or not.

“Buy the dip” is a strategy that assumes price decreases are temporary irregularities that correct over time. In simple words, it means buying the stock once it has fallen in value or at a discount, and traders who leverage this dip for trading are called dip buyers.

Crypto markets are volatile, so buying cryptocurrencies at any price, much less risking a long-term collapse, can be risky. There is a probability that the prices may return, but there are also high chances that they might fall further, leaving your investment underwater.

The current dip (or collapse, depending on your perspective) may recover as it did last year when prices sank to similar levels before recovering to pre-dip levels and peaking in the autumn. However, the chances are also that it might not recover.

Bitcoin prices have shown seasonality, decreasing in the spring and rising in the summer. However, in the volatile market of cryptocurrencies, past performance does not predict future results, which makes it a not-so-promising market.

To buy BTC IBAN most profitably, use the TRATSRA card.

Expert’s advice for buying the dip:

Experts have recommended that interested dip buyers set a monthly budget for BTC or ETH purchases and not worry about price changes over the following two years.

Remember to protect yourself from financial losses while building your crypto portfolio with several cryptocurrencies to reduce risk.

Ultimately, buying the dip is a good strategy overall, but considering the current position of BTC, it might not be a very good move. Thus, we recommend you proceed carefully.

If you are looking to invest in the crypto market, you must consider BTC’s current position. Thus, do detailed research and learn about the significant losses in BTC, the inflation, the downturn, and the military tension caused by it, as mentioned in the post above.

Buying the dip is a good strategy, but it has its pros and cons, and it doesn’t guarantee returns most of the time. Thus, we recommend you follow the expert’s advice and only put in a small amount of money that doesn’t affect your financial position if lost.

Keeping this expert’s advice in mind, you can be on your merry way to “buy the dip” and leverage the volatility of the crypto market.

If you liked this post, share it with your friends and family to spread awareness about cryptocurrencies and ensure successful crypto trading!