It’s foolhardy not to keep a record of important business decisions because it can put a company’s tax advantages and liability protection at risk.

Fortunately, a systematic record of corporate minutes and resolutions, which document all major business decisions and the votes taken to approve them, considerably aids in solving the issues.

Corporate minutes are crucial components for companies to grow and sustain themselves in the marketplace; they can either break or make your company’s reputation. So, what does it take to take more effective corporate minutes at board meetings? Let’s start with the basics.

Corporate minutes refer to the documentation of what board members have talked about during business meetings, such as actions and decisions taken by the company.

Business meeting minutes are usually recorded by the company’s secretary and then sent out to all participants afterward.

While the requirements for business meeting minutes vary by company and state, the main objective behind the documentation of major decisions is usually the same: to hold the company liable for ethical operation under the company’s bylaws.

Also, keeping a record of corporate meetings demonstrates that the company holds frequent board meetings.

Simply put, whoever is jotting down the corporate minutes should record the major decisions that were made, the topics related to the organization’s strategic directions, and the action plans that came out of the board meeting.

It’s not necessary to write down every single bit of it. Nonetheless, you should know what topics were discussed, who suggested what, and who all are responsible for the assigned tasks.

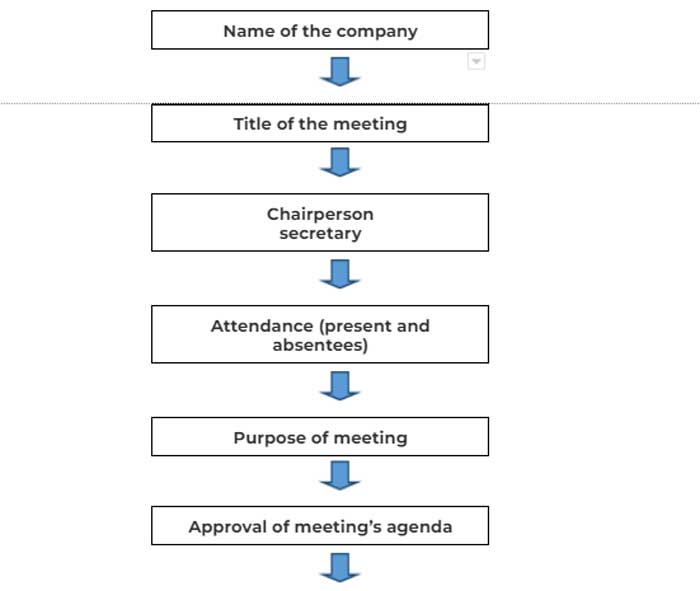

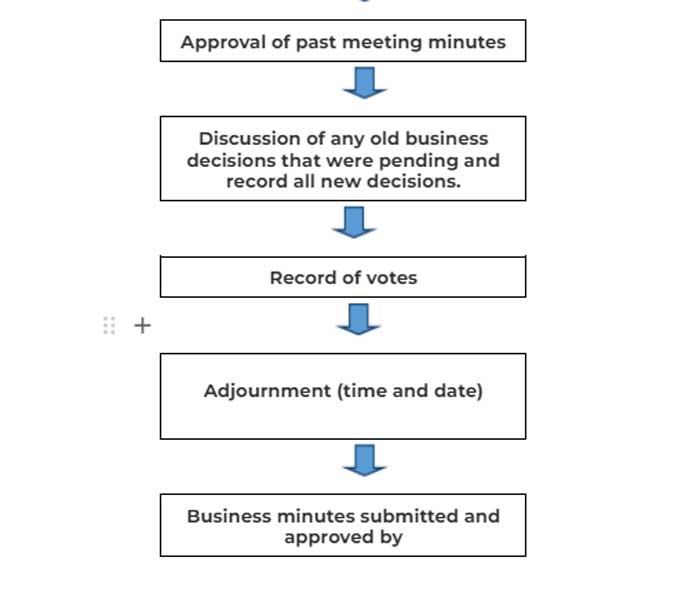

Here is a list of some of the corporate minutes’ requirements that you need to keep in mind while recording:

Apart from this, corporate minutes should also note if anyone left or arrived late to the business meeting.

The hiring of new employees, financial transactions, issuance of new stock, and new board officer announcements are a few examples of the type of decisions that should be a part of corporate meeting minutes.

While it’s important to know what to include in a corporate meeting, it’s equally vital to know what shouldn’t be a part of your corporate meeting minute.

Thus, eliminating irrelevant information keeps your corporate meeting minutes from exposing your board to legal issues.

You should use a corporation minutes template when you need to write a summary of topics addressed during the business meeting of the board of directors.

Also, the board is responsible for fiduciary and legal duties, so it’s crucial to keep a record of actions and decisions that the board takes during a business meeting.

What’s more, taking corporate minutes using board meeting software has indeed become a good practice for enhancing corporate governance.

Using a template to record corporate minutes saves time and other valuable resources including money. Instead of writing and organizing the files on the go, using a preset template makes it easy to record corporate minutes promptly.

Here’s a free corporate minutes template that reflects the structure of the official business meeting:

The majority of the states require C and S corporations to retain a record of crucial company decisions and meetings.

Oklahoma, Nevada, Delaware, Kansas, and North Dakota are the only states that don’t require corporate minutes to be preserved.

Also, corporations constituted as LLCs are exempt from retaining corporate minutes.

In an era of the digital world, you can’t squander a single second recording sloppy corporate minutes at your organization’s meeting. Although keeping a record of business minutes isn’t mandatory in every state, doing so is always a smart move.

All recording meeting minutes takes is an understanding of what should and should not be a part of a business meeting minute.

With these strategies in your backpack, you will be able to seamlessly streamline your meeting follow-ups and get back focusing on achieving your company’s goals.