Key Takeaway

Hedge fund is an alternative investment funding where professional investors’ money is pooled and through diversifying strategies high-returns are generated. Fun part is hedge funds can play both sides of the market, benefitting from both rising and falling prices as they use a variety of investment strategies, from long-short equity to market-neutral, global macro, and even event-driven strategies

If you’ve recently embarked on your investment journey, you’ve probably heard about hedge funds. These are also called alternative investment funds. They pool money from professional investors and are interestingly managed by institutional investors who utilize non-traditional investment strategies. Although these entities command a significant portion of the financial market, they remain a confusing topic for many novice investors.

Former writer and sociologist Alfred Winslow Jones’ company, A.W. Jones & Co., launched the world’s first hedge fund in 1949. John was impressed by the money and management concept, raised $100,000 (including $40,000 out of his pocket), and tried to minimize the risk of holding long-term stock positions by short-selling other stocks.

Jones was the first money manager, to sum up short selling, leverage, and shared risk by partnering with other investors. For this innovation, and by making the use of a compensation system based on investment performance, Jones became a significant part of investing history as the father of the hedge fund.

Simply put, a hedge fund is a type of investment vehicle that pools money from multiple investors together when utilizing diverse strategies to generate high returns. Diversifying the investment strategies is vital for a successful investment portfolio as there are fewer risks involved and the investor is not dependent on the asset class.

It’s not uncommon for hedge funds to use complex financial instruments and take riskier positions, often ‘hedging’ their bets to limit potential losses. As per various experts, hedging in financing is similar to traditional fencing but sometimes creates barriers to security and privacy.

The Hedge Fund industry took off in the year of 1990s when big-profile money managers deserted the mutual fund’s idea for hedge fund managers. It operates in various countries apart from the U.S. and abides by the rules of that home country.

Unlike traditional investment routes, a hedge fund trader isn’t restricted to the conventional buy-and-hold strategy. Instead, hedge funds can play both sides of the market, benefitting from both rising and falling prices. They use a variety of investment strategies, from long-short equity to market-neutral, global macro, and even event-driven strategies.

This versatility is a unique hallmark of hedge fund trading and can provide an investor with exposure to a plethora of asset classes and market opportunities. It belongs to the asset management industry and has earned $4.2 Trillion in assets under management in 2022.

Interesting Fact: A hedge fund is quite different from a mutual fund as the former raises funds from institutional investors while the latter can do it with anyone in the general public.

A skilled manager is at the helm of each hedge fund, responsible for navigating the financial markets. These financial experts leverage their solid understanding of market trends, economic indicators, and company fundamentals to make investment decisions that seek to maximize returns and minimize risk.

Before you dive headfirst into hedge fund trading, it’s imperative to understand that this route is not designed for everybody. Typically, hedge funds are the domain of accredited investors – individuals or entities that meet specific financial and net worth criteria. This is mainly down to the high-risk nature of hedge fund trading and the substantial investment sums that are often required.

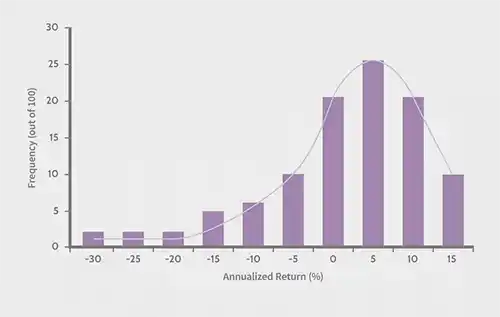

Generating a return is the goal of any investment. However, the potential for higher returns in hedge fund trading often comes together with a higher level of risk. From liquidity issues to market volatility, there are several factors at play. While hedge fund managers work hard to ‘hedge’ against these risks, it’s vital for any prospective investor to be aware of them and be comfortable with the potential downsides.

Diversification is a cornerstone concept in hedge fund trading. It refers to the practice of spreading investments across a range of different assets to reduce exposure to any single one. In the hedge fund arena, diversification extends beyond the realm of asset classes and geographic locations.

It utilizes a range of strategies and financial instruments, including leverage and derivatives. This broad approach helps with mitigating risk when maintaining the potential for high returns. The versatility of hedge funds means they can exploit a broad range of investment opportunities, which can be especially valuable in times of market uncertainty.

Bear in mind, however, that while diversification can reduce risk, it does not eliminate it. Because of this, prospective investors should always carry out comprehensive due diligence before getting started.

Hedge fund trading is an intricate web of strategy, risk, and potential return. It offers a unique and potentially lucrative avenue for financial growth for adventurous investors who are ready to explore complex investment strategies.

Hedge funds are open-edge funds but fund managers do not always accept new subscriptions and this clearly limits the investor. The most disturbing point is that fund managers can also disapprove investors temporarily from taking redemption when they have subscribed. This move is usually called “Gates” and was utilized during the 2008-2009 Global financial crisis when the market downturn portfolios struck.

Interesting Fact: Hedge Fund industry had $4.18 Trillion in assets in 2022 according to the Preqin global hedge fund report of the year.

These are some of the largest Hedge funds according to Pitchbook’s data as of January 2022.