Dividend investing has become an increasingly attractive strategy for generating consistent income and long-term wealth. Globally, corporate dividends continue to set new records.

According to Janus Henderson, global dividends surged to a record $1.75 trillion in 2024, representing a 6.6% underlying increase. This momentum is projected to continue, with forecasts suggesting payouts could reach $1.83 trillion in 2025.

While the allure of high yields is undeniable, successful dividend investing transcends merely scouting the highest percentages. A strategic roadmap, balancing income generation, sustainability, and growth potential, is crucial for success. Many investors err by fixating solely on payout percentages, neglecting the fundamental financial health supporting those dividends.

Thereby, this comprehensive article provides essential guidance to identify high dividend stocks aligned with your investment goals.

KEY TAKEAWAYS

- Don’t chase the highest yield; focus on the sustainability and growth potential of dividends.

- Prioritize companies with strong balance sheets, manageable debt, and consistent cash flow.

- Look for a long track record of sustained or increasing dividend payments, especially through economic cycles.

- A healthy payout ratio (e.g., 30-60%) indicates a company can afford its dividends and has room for growth.

- Invest in companies with competitive advantages and stable, predictable revenue streams.

- Understand industry trends and a company’s positioning within its sector for long-term dividend reliability.

- Assess leadership’s strategic vision and capital allocation discipline.

- Buy quality dividend stocks at a fair price; even great companies can be poor investments if overvalued.

- Dividend investing is a long-term strategy requiring patience and continuous monitoring.

Before being swayed by an appealing dividend yield, thoroughly examine the company’s stability and financial health in detail. In most cases, strong dividend payers possess healthy balance sheets carrying an element of manageable debt and consistent generation of cash. An organization should also have a debt-equity ratio that is within the industry benchmarks, because too much borrowing would be a factor that could compromise the future payment of dividends.

Also, verify the history of the earnings of the company to make sure that the profits have grown or have not varied over several years. In hard times, the companies with unpredictable profitability might find it hard to maintain their consistent dividend payments. A robust financial foundation acts as the cornerstone upon which long-term dividend payments are constructed.

Valuable benchmarks about the commitments made by the management to shareholder returns and the solvency of the firm can be expounded through the history of dividend payable by a company. Determine companies that have improved or sustained its paid dividends over time periods of many decades or alternatively many economic cycles.

Especially consider the way in which businesses had treated their dividends in earlier industry downturns or in prior recessions, as that behavior often uncovers how they would respond to hard times in the future. In fact, businesses with long streaks of dividend growth and high levels of operational excellence, and financial discipline are entitled dividend aristocrats.

However, it is important to note that past performance is never guaranteed in the future, so combine the past history analysis to the current financial assessment.

One of the important metrics of dividend sustainability is payout ratio, as it indicates the ratio of earnings paid out as dividends. Organizations that pay back 30-60 percent profit tend to have well-built dividend policies and they can grow, whereas those that pay more than 80 might feel under pressure.

You must compare businesses within its own industry and not across all markets as the standards of payout ratios might be different across industries. An appropriate approach in attaining a comprehensive picture of dividend sustainability is to consider earnings payout ratio and free cash flow payout ratio.

Companies that regularly pay healthy payout ratios in performing so show quality financial management and create room to accommodate unanticipated challenges.

INTERESTING FACT

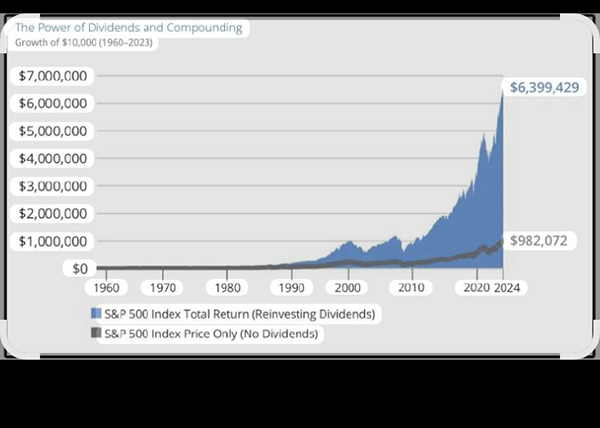

Since 1960, approximately 85% of the cumulative total return of the S&P 500 Index can be attributed to reinvested dividends and the power of compounding.

Invest in businesses with strong, defensible business models capable of generating consistent cash flow regardless of economic conditions. Identify firms possessing competitive advantage against the competitors, such as popular brands, essential products or services or market dominance.

Defensive businesses, like utilities, consumer staples, or healthcare, often provide more predictable dividend streams compared to those in cyclical industries. Find out whether the goods and services provided by the firm are still applicable to the needs of the changing consumer demands and due to shifts in technology.

Some time later, the more stable dividend slightly tends to be given by the intensive company models showing steady income, or demand patterns.

To identify companies poised for long-term profitability and persistent dividend increase, investors have to know more about the bigger picture in the industry.

Analyze whether the industry is expanding, contracting, or undergoing transformative changes that could impact future profitability and dividend payments. The firms that lead their industry with market share, innovation, or operating efficiency often remain capable of paying dividends better than less competitive competitors do.

Assess the possible impacts of customer preference, new legislations, and technological disruption on the future of the industry. Investing in businesses well-positioned within stable or growing markets increases the likelihood of consistent or growing dividend payouts.

Sustainable dividend programs are underpinned by strong leadership teams with a clear strategic vision and strict capital allocation procedures. Research management’s history of overcoming obstacles, fulfilling commitments, and reaching shareholder-friendly conclusions in a range of market circumstances.

Take note of the management’s communications on the dividend policy and its stated objectives with regard to shareholder returns, capital allocation between debt reduction, and growth initiatives.

Companies that communicate their dividend plan in an open and continuous manner are often more dependable dividend payers. Management teams that effectively balance growth investments with shareholder returns typically generate the highest long-term value for dividend investors.

Valuation is a crucial consideration in a decision to invest in a stock because even a profitable high paying dividend stock can make a bad investment in case it is acquired at a high price. Examine price-to-earnings ratio, picture ratio, and other relevant indicators in the present stock and compare them with industry players and historical standards.

The quality dividend equities that appear to be trading at a fair price often yield superior total returns, even if their initial yield appears modest. Be patient and await opportune entry points; market volatility frequently presents chances to acquire high-quality dividend companies at attractive valuations. Note that dividend yield increases as stock prices fall, but before thinking greater yields indicate better value, be sure the underlying company is still doing well.

To select outstanding high-dividend stocks, a systematic process far beyond simply chasing the highest yields. By utilizing factors such as rate of dividends, financial health, dividend sustainability, excellent management, business model soundness, industry positioning, value, and diversity one can be able to develop a portfolio of good dividend companies.

These companies are able to generate stable income and long term wealth generation.

Remember that dividend investing is a marathon and not a sprint game, demanding patience, discipline, and continuous monitoring of your holdings.

A dividend aristocrat is a company that has consistently increased its dividend payments for at least 25 consecutive years, demonstrating exceptional financial strength and commitment to shareholders.

The yield might be artificially inflated because the stock price has fallen significantly due to investor concerns about the company’s ability to sustain future dividend payments.

Reinvesting dividends can significantly accelerate wealth accumulation through compounding, as you buy more shares which then generate more dividends. Taking cash might be suitable if you need the income for living expenses.

A strong balance sheet, characterized by low debt and robust cash flow, provides a company with the financial flexibility to maintain dividend payments even during economic downturns or unexpected challenges.