You know, it is a dream for many traders to make it big in the world of the financial market.

Forex is one of the biggest marketplaces in the world that allows investors to bet on a country’s currency.

Will it go up or will it fall? This is the question that many investors bet on.

But still, simply investing directly will not make you any money.

Every market has a spread and so does Forex.

In this article, we will get to know what spreads are, their types, and how forex brokers with the lowest spreads can make some pretty huge profits.

And, as a bonus, we will also give you a list of some of the best forex brokers, apps, and more.

Spreads can pretty much decide how much profit a trader will make.

If we look at it simply, it is basically the difference between the lowest price that a seller is willing to sell their assets and the highest amount a buyer will be willing to pay for them.

It is usually set by the market maker, who decides how much the bid and ask price for an asset will be.

DID YOU KNOW?

The volume of trading in forex markets stands at more than $5 trillion a day, much more than the volume on the New York Stock Exchange.

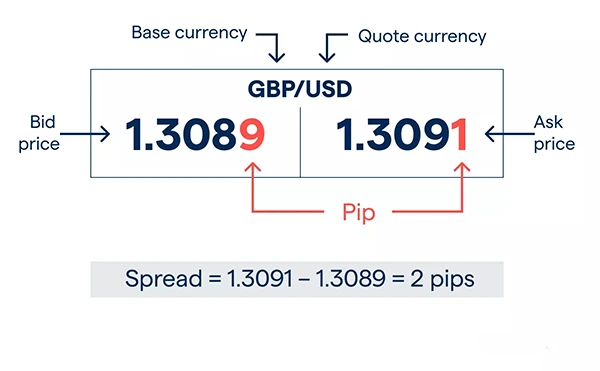

If you want to calculate the spread in forex, you need to find out the difference between the buy and sell price of an asset in pips.

You can do this by simply subtracting the bid price from the ask price.

For example, if you’re trading on a GBP/USD pair at the price of 1.3089/1.3091. then you can calculate the spread by subtracting the two, i.e., Ask Price – Bid Price

Which comes out to 2 pips.

You know, spreads can be either wide (high) or tight (low).

The greater the difference between the asking price and the bid price, the more pips you’ll get and the wider the spread will be.

This means that the market is pretty volatile at the moment and the asset will not be very liquid.

And if you take a look at a professional trader’s portfolio, you’ll see that oftentimes these traders will prefer to make low-spread bids as these trades are more affordable to them.

But, this spread will not always be the same.

It can change pretty often and it becomes harder for traders to decide when the right time to place a bid is.

We all know that the prices of assets in the global market change pretty often and the same is true for forex too.

The spread in forex can change when the difference between the buy and sell price for a currency pair changes.

This is known as a variable spread, and when you’re dealing in forex, you’ll have to deal with this variability too.

So, why does the spread change so much, you ask?

Well, the spread of these currency pairs is pretty much affected by everything from geopolitical tensions, important news announcements, or an event that can cause high volatility in the market.

For example, the pandemic, the Russia-Ukraine war, and the recent Hamas incident caused some pretty drastic changes in the spread of many of the global forex currency pairs.

So typically, if there is a low spread between currency pairs, this means that the market is pretty stable, has high liquidity, or both.

This also means that there are a lot of traders in the market and you can buy a large number of contracts without affecting the market by much.

A high spread means that the market is currently going through something and is pretty volatile, has low liquidity, or both.

And, in some cases, this also means that the price is moving a lot and that it is becoming harder for brokers to buy or sell contracts.

This is the reason why many traders choose to trade on lower spreads.

So, before you start on your trading journey, here are some forex tips you need to know about.

For many forex traders, having a low spread means that they can keep their trading costs low.

Here are some ways that low spreads can benefit you:

You know, low spreads can help you a lot when you want to keep your trading costs low.

Usually, every time a trade is made, a trader has to overcome a spread to actually start making some profits.

So, the lower your spreads are, the less the price needs to move before you start seeing profits, and the lesser the chances of you making huge losses.

Traders, who usually like to use high-frequency trading strategies, need to enter and exit the market constantly.

Having lower spreads means that you need to pay less for these types of trades.

This basically means that, if you make a trade with a lower spread, your distance to a profitable trade is just that much closer.

So, making trades with lower spreads can help you make a lot of profits quickly, even if the market is pretty iffy.

If all this talk of forex and profits has made you interested in getting into the world of forex trading, you first need to have a good broker who can help you make trades with the lowest commissions.

Lucky for you, there are a ton of options available on the internet, but there are some things you need to keep in mind when you pick a forex broker for all your trading.

To truly evaluate the quality of a broker, you need to think about all the trading costs, and yes, this includes your broker’s commissions too.

Also, keep in mind that some brokers out there will give you low spreads but their commissions will be just so high that you won’t actually be making any profits trading with them.

In recent years, we have seen many different forex broker platforms rise, which has also resulted in an increase in competition.

This is a good thing for you because the forex trading costs will continue to get even lower as these brokers compete to win you as a client.

In fact, there are many forex brokers out there who pretty much offer zero-spread trading accounts as an extra to get you to use them for all your trades.

They are the type of financial service that allows you to bet on currency pairs in the global market. Brokers act as middlemen between traders and the market and facilitate trades securely and safely.

Disclaimer: Please keep in mind that many forex brokering services will offer zero-spread accounts as a marketing gimmick. You need to always read the fine print and do your due diligence before settling on a forex broker.

Here are some of the best forex brokers that offer the lowest spreads in the market and best of all their commissions are pretty minimal too.

It is one of the best ECN trading services, with faster trades and a wide range of third-party platform integrations.

This is why it is loved by many professional and beginner traders around the globe.

Aside from all this, Pepperstone’s 30-ms executions make it the go-to choice for many high-frequency traders.

Tickmill is a pretty famous and reputable FSCA-regulated forex broker that has consistently shown us its reliability and transparency over the years.

It has some of the industry’s lowest commissions, which makes it pretty popular among many traders who want to save up on costs.

Plus, it gives its users a fast and free deposit and withdrawal option.

And any new traders that sign up with Tickmill get a $30 bonus for joining the service.

This forex broker has the highest trust ratings in the industry.

IC Markets is known for its low trading costs and choice of platforms, it also comes with a pretty wide range of trading tools to help its customers.

This broker also holds the license for one of the most reputable regulators in the industry.

Plus, it’s great for beginners because of its exceptional 24/7 customer support, which can easily help you with your account setup and technical issues.

If you want to look for a broker service on your own, there are some things you need to look into when comparing low-spread broker services.

While keeping your trading costs low might be lucrative enough, there are often other ways that these brokers are making their money off of you.

Here are some things you need to look into before settling on a forex broker:

You need to make sure that your broker is regulated by a reputable financial authority.

This can give you a level of security and can help protect your investments from any foul play.

Look into your broker’s past record and see if they have been giving a consistent and reliable service that is easy for even beginners to use.

Also, check to see if there are tools and other features available that can help you with your trades.

Your trades need to be fast so that you can get your bids in at the price you expect.

Any delays will potentially make you lose money or be set at a price that is not desirable for you.

We all know that, as chaotic as the financial market is, having good customer support can give you peace of mind.

A good broker’s customer support needs to be experienced and good enough to help you if any issues occur when executing your trades.

You know some brokers will pile on hidden fees on their deposits, withdrawals, or account inactivity.

You need to make sure that you look into these little things before opening an account with any brokers.

Forex trading lets you trade on currency pairs from across the globe, but you need to keep in mind the spread if you want to make an actual profit.

Many traders prefer to bid on low spreads because they do not need to wait for much to actually start making profits,

You need to understand what low spreads in forex markets are and how you can benefit from them.

As a bonus, we’ve also shared with you some of the most popular forex broker services with the lowest commissions and the best transparency and reputation in the industry.