Payroll taxes are an amount withheld from an employee’s salary by employers, which they must submit to the government. It is a legally mandated responsibility that every business owner has, irrespective of their size or level of employment.

These funds go towards supporting national programs like Social Security and Medicare. Notably, it’s not just employees who contribute, as businesses themselves have portions to pay too.

In terms of dealing with your payroll taxes effectively, there are different aspects to get right and different rules to follow depending on the size of your organization. Stick with us as we break this down for companies across the spectrum.

For larger businesses, managing payroll taxes effectively is a pivotal task. A myriad of factors can influence how much you owe, but let’s start with the necessities:

Regardless of size, every business must consider these points when calculating payroll taxes. However, large corporations face extra complexities due to high headcounts and diverse employee benefits schemes overseen by monitoring software.

STATISTICS:

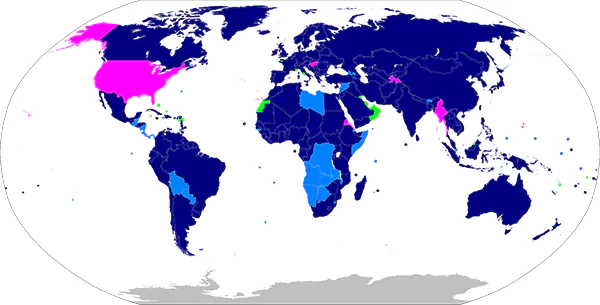

This map is taken from Wikipedia showcasing the World map of countries by their system of taxation on individuals in 2019.

Systems of taxation on personal income

- No income tax on individuals

- Territorial

- Residential

- Citizenship-based

That’s where advanced accounting software steps in. Automation can handle voluminous calculations accurately and on time, freeing up yours to focus on other strategic areas of running your big enterprise without getting bogged down in the figures.

Whereas larger corporations may have complex payroll obligations, small businesses also face unique challenges. The major steps largely remain the same, but with some clever strategy tweaks you can streamline your calculations:

Another specific aspect is size-induced fluctuations in staff numbers. You might recruit extra help during busier seasons only to scale down later, so be cognizant that part-time or temporary personnel are still subject to payroll tax rules.

Finally, despite the relative simplicity compared to giant enterprises’ payroll management needs, leveraging technology for automation remains a wise decision even here. This not only applies to payroll tax calculations and processing, but also to things like issuing salary payments to team members and fulfilling the invoice requests of freelancers.

Once again, the location of your business matters here. States have very different rules regarding tax, so you have to use software to your advantage. For instance, OnPay’s Florida tax rates calculator is a quick and easy way for small and large organizations alike to get the numbers right if they’re in a hurry and a deadline is approaching.

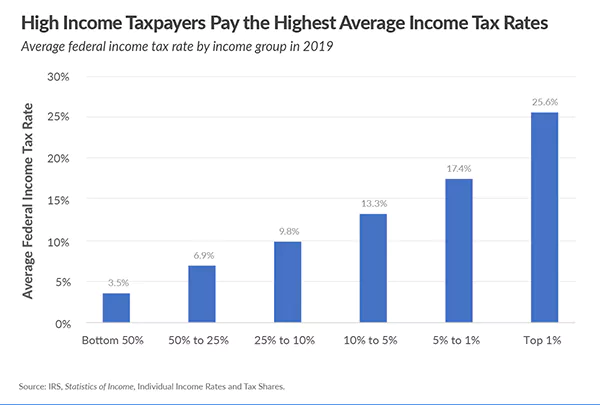

INTERESTING STATISTICS:

- This data shows that In 2020, taxpayers with higher incomes paid much higher average income tax rates than taxpayers with lower incomes.

- According to the Tax Foundation, “The bottom half of taxpayers, or taxpayers making under $42,184, faced an average income tax rate of 3.1 percent. As household income increases, average income tax rates rise”.

For independent businesses and freelancers, payroll tax calculation includes some unique aspects. These individuals often wear the employee and employer hats simultaneously, transforming their taxation approach:

Though handling it single-handedly may seem stress-inducing initially, efficient record keeping coupled with using simplified tax software can make this process smoother.

In essence, effectively managing your business’s payroll taxes involves understanding the nuances of varying business structures and potential differences by state.

Be it a large corporation, small business, or independent platform, each comes with unique aspects to consider when calculating respective payroll tax duties.

Adopting technology in the process can ease these complex calculations, ensuring accuracy and compliance every step of the way.

The taxable income of a business is calculated by deducting the cost of sold goods and expenses from the total sales.

Payroll taxes comprise wages, gross salaries, perks, and any form of remuneration that is paid to the employees.

Collecting employee information, setting up a payroll schedule, tracking time worked and money owed, issuing payments, and keeping accurate records.