Everyone agrees that managing your finances is important because nobody knows when one might go into debt. We used to write down all our expenses and then calculate it. Have a cup of tea, your finance journal, and a calculator. Sounds like a date, doesn’t it?

But do we still do that? Yes, every person, firm, or organisation does their finance. By hiring someone, using any app, or doing it themselves, we still do take care of our finances.

Benjamin Franklin, also known as the founding father of the US, has said “A penny saved is a penny earned.” Every single penny that you save is going to save you in the future, that’s why saving is also called earning.

In this article, we’ll understand the concept of personal finance and why it is important in the modern world.

Personal finance encompasses the management of an individual’s or household’s financial activities. This includes earning income, budgeting, saving, investing, handling debt and planning for future needs.

Effective personal money management requires informed decision-making across various areas, including spending habits, savings goals, wealth enhancement strategies and asset protection through insurance and estate planning.

Mastering personal finance is essential for achieving financial stability, reducing stress, and pursuing important life goals such as homeownership, starting a business, or enjoying a comfortable retirement.

It empowers individuals to make educated financial choices, leading to greater economic independence and security.

Personal finances impact numerous aspects of an individual’s life, from day-to-day decisions to long-term financial security. People who have a habit of managing their expenses are said to do good financially in the long run. Let’s explore the key reasons why it is so important:

Effective personal finance management empowers individuals to set and pursue their financial objectives. These goals can vary widely, from short-term aspirations like buying a car or taking a vacation to long-term dreams like owning a home, saving for retirement, or funding education.

Individuals can turn these aspirations into a tangible reality by carefully planning and managing their finances. Managing your finances will give you insight into where you can save or cut off your expenses and save it.

You will also get the idea of how long it will take you to reach your goal.

Responsible financial management ensures that you have sufficient funds to meet your needs and handle unexpected expenses. By implementing effective budgeting and saving strategies.

You create an economic safety net that provides stability and reduces the stress and anxiety associated with financial uncertainty. You will feel relieved knowing that you have your finance order and can doge or face any financially related challenge.

A solid understanding of personal finance facilitates effective debt management. This knowledge helps you avoid high-interest costs and potential financial pitfalls. Good debt management practices also help maintain a healthy credit score and financial reputation, making it easier to secure loans when needed in the future.

Gaining insight into personal finance enhances your financial decision-making capabilities. It improves your financial literacy, enabling you to navigate complex financial products effectively, avoid fraudulent schemes, and maximise the use of your resources.

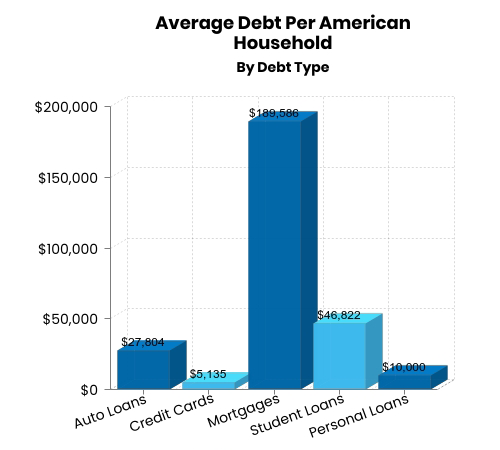

Not only that, but having info about personal finance can help you get out of debt, or might never put you in any debt to begin with. Look at this chart given below.

You can see how much debt people have in an average American household. But at the same time, if these people had made some plans, they would’ve overcome this. This is why knowing your finances is important.

Personal finance equips individuals with the tools and insights to enhance their wealth through strategic investing and saving. This foundation is crucial for establishing a secure future, achieving financial independence, and enjoying the freedom to make life decisions without the burden of financial constraints.

Life is unpredictable, and emergencies such as job loss, medical crises, or major repairs can arise unexpectedly. Personal finance emphasises the importance of maintaining an emergency fund, a crucial safety net during unforeseen circumstances.

This preparation allows you to manage unexpected events without compromising your financial stability.

FUN FACT

In all countries combined, humanity is around $315 Trillion in debt.

Although personal finance might initially appear simple, it involves many practices that can differ significantly between individuals and families. These practices often include managing cash flow and developing personalised budgets to suit specific needs and circumstances.

By gaining mastery over personal finance, individuals can take charge of their financial futures, make well-informed decisions, and strive towards a more secure and prosperous future.

Personal Finance is something everyone should take seriously. As soon as you start earning you should have proper insight on what you have to do and what you don’t, this way you can save yourself from a lot of troubles in the future.