Peer-to-peer or person-to-person (P2P) financial apps are emerging universally, with millions of users (consumers and businesses). 2.3 billion Zelle payments were recorded with a total value of $629 billion. The figures also showed a 59% increase in the value of amount transfers and a 49% rise in other transaction volumes.

Online payments, purchases, etc., are more popular than ever before. Advanced platforms like PayPal and Venmo, due to their potency to meet user’s requirements have swiftly benefitted.

In this column, we’ll dig into the significance of these applications in the fintech sector, scrutinize the features of the products, and seek the diverse stages of its development process. So, let’s get started.

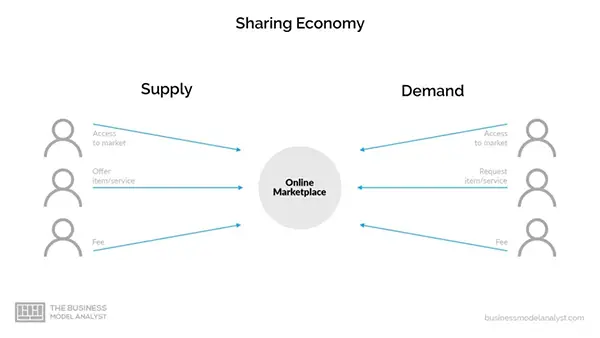

Let’s explore how P2P payment applications shape various business processes and models.

Entrepreneurs in the P2P Payments market often fall into three categories:

According to Statista, Venmo’s total payment volume in the fourth quarter of 2022 showed year-on-year growth of about three percent – the company had nearly $63 billion worth of TPV, compared to $60 million in Q4 2021. However, ensuring your P2P app can accommodate surges in payments and user activity is essential. Expansion into other regions globally can also be considered.

Considering that over 6 billion people worldwide use smartphones, and this number is projected to increase by several hundred million in the coming years, focusing on countries with the highest number of smartphone users, such as China, India, and the US, can lead to rapid company’s growth in the market.

Thus, the P2P market can significantly influence trades in various ways.

When developing an app, it’s essential to understand the types of products and business models available. This knowledge will guide you in choosing the platform type that best suits your needs. Let’s explore some options:

These allow users to link their bank cards and establish a digital wallet for storing electronic funds, making payments, and transferring money. For instance, PayPal offers services for both sellers and personal consumers. It boasted $27.5 billion in revenue in 2022, an 8.6% increase year-on-year, according to Business of Apps.

Examples: PayPal, Venmo.

These services are installed on smartphones, where users can add bank cards. Payments can be made in stores equipped with NFC technology using smartphones, wristbands, or smartwatches.

Examples: Google Pay, Apple Pay, and Samsung Pay.

Banks often set up their P2P systems to enhance accessibility and convenience. If both the sender’s and recipient’s banks have integrated Zelle into their apps, transfers can be conducted in minutes.

Examples: Zelle, Popmoney.

Money can be transferred on social networks to chat partners. Advanced features such as online shopping, bill payments, ticket purchases, cab booking, and more are also available on some platforms.

Examples: Snapchat, WeChat, Facebook, Messenger, Instagram, and WhatsApp.

When determining the nature of your product, delve into the fundamental features of a payment app MVP. Knowing what to include in your project is crucial for its success.

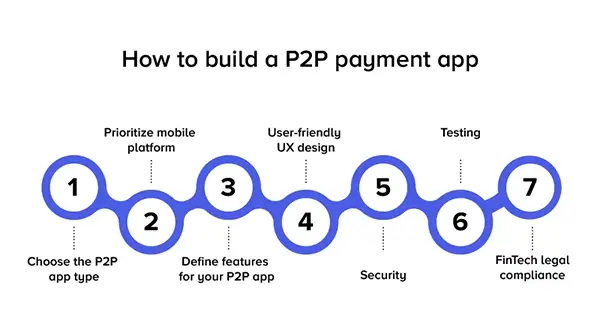

Armed with a list of crucial features, here are the steps to create your product.

Some of the likely challenges faced in the development process of the P2P software are given in this section.

Ensure your product is secure. Use two-factor authentication and establish transaction limits to protect customers’ accounts.

Adhere to the Payment Card Industry Data Security Standard (PCI DSS), which includes maintaining up-to-date safety policies, robust access control standards, and a vulnerability management system.

Be aware of regional constraints. Users should be able to send and receive money globally.

Consider a mechanism for resolving disputes related to failed transactions.

Enable people to exchange various world currencies within the platform.

Build robust security layers to protect against fraud. Consider integrating blockchain technology for added safety.

Ensure consistent synchronization of financial data across multiple devices and automatic updates.

To conclude, creating a P2P payment app requires a sophisticated process that involves careful consideration of consumer demand, technological possibilities, and security measures.

The CEO of Softermii, Slava Vaniukov says, “In the rapidly evolving financial landscape, P2P payment apps are not just a trend, but a necessity. Navigating through the complexities of building a successful app is challenging but rewarding. At Softermii, we believe in delivering innovative, secure, and user-friendly solutions that cater to the demands of the global market”.

Hence, analyzing potential challenges to provide a user-friendly, secure, and efficient platform to people is the ultimate goal.