GST Suvidha Kendra is one place for providing all GST-related consultant services to people. An Indian citizen who wants to start or expand their business can take assistance or avail of facilities of the GST suvidha center. It is not limited to providing guidance, they also help people get aware of the GST term, registration process, return filling, etc.

You can run your own GSKs as your business and with time and knowledge, you can earn Rs.40,000 to 1,00,000/ per month from GST suvidha Kendra. So, read out this article to know about the process of earning from it and its franchise.

GST stands for Goods and Services Tax. GST was introduced on 29th March 2017, and it came into practice on 1st July 2017. It is an indirect tax that improves the process of taking taxes from citizens, and it is applied to the supply of goods and services in India. After GST came into existence, many indirect taxes have been changed including service tax, excise tax, VAT, etc.

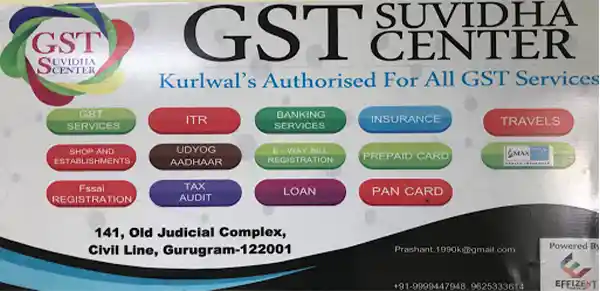

GST Suvidha Kendra is a center where people can go to get help with their GST-related tasks. These centers are authorized by the government to provide various GST-related services like registration, filing returns, and making payments. They help taxpayers who may not be familiar with the GST system or who may not have access to the internet to complete their GST-related tasks easily and efficiently. These centers are set up all over India, and they aim to make the GST system more accessible to everyone.

The GST system can be complex, and some people may find it difficult to understand and navigate. Additionally, not everyone may have access to the internet, which can make it challenging to complete GST-related tasks online. GST Suvidha Centers are authorized by the government to assist the people of India and provide them with complete guidance.

GSKs offer numerous advantages to people and organizations, here we have discussed some common ones:

Accessibility: GST Suvidha Kendra makes it easier for taxpayers to access GST-related services. They can provide assistance to those who may not be able to access online services due to a lack of resources or technical knowledge.

Efficiency: These centers can help taxpayers to complete their GST-related tasks efficiently and effectively. They provide one-stop solutions to various GST-related queries and can help taxpayers to save time and effort.

Expertise: GST Suvidha Kendra staff are trained and authorized by the government to provide GST-related services. They have expertise in the field and can provide accurate and reliable information to taxpayers.

Cost-effective: GST Suvidha Center services are generally affordable, making it easier for taxpayers to access GST-related services without incurring significant expenses.

Convenience: It offers convenience to taxpayers as they can easily access these centers, which are usually located in easily accessible locations. They can also avail of services at a time that is convenient for them.

GST Suvidha Provider (GSP) is a company that provides technology-based solutions to help taxpayers comply with GST regulations. GSPs are authorized by the government to develop and provide software applications that help taxpayers manage their GST-related tasks. These applications are usually available online and can be accessed through a web browser or mobile app. GSPs play a crucial role in the GST ecosystem as they help to simplify the GST compliance process and make it more accessible to taxpayers.

There are multiple ways to earn from GSKs. You can charge clients for their GST registration, or GST return filing. Another way of earning is to add 15 clients every month and take commission over them. You can earn from the one-time registration process, while the monthly account and return filling can increase your income from GSKs.

But it’s essential to ensure that you comply with all relevant regulations and guidelines while providing these services. By providing valuable assistance to taxpayers, you can build a loyal customer base and earn a steady income from your GST Suvidha center.

It’s important to get suggestions from a person who really has hands- on experience in this particular field.

Here is a discussion on Quora about GST Suvidha Kendra, you can know more about this comment through this link- https://www.quora.com/How-much-profit-can-we-earn-by-opening-GST-Suvidha-Kendra

Here is the link of Top 3 Reputed & Trusted GST Suvidha Kendra Franchise Providers

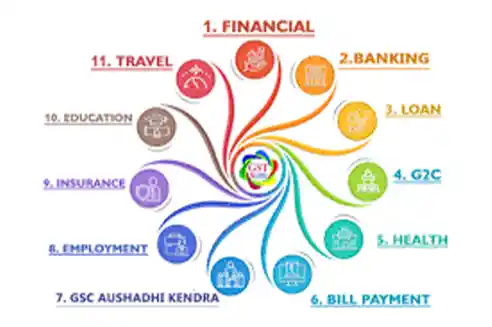

GSKs provide a wide range of facilities to taxpayers and organizations. These are some of them:

For the GST suvidha Kendra franchise, you have to pass the eligibility criteria, which are mentioned below.

If you want to register on the GSKs portal, follow these steps.

To start your own GST suvidha Kendra franchise you have to register to the GSKs portal which is an easy and quick process. After successfully registering, you will get further assistance from their experts. Here, we mentioned the list of top GST suvidha Kendra franchises.

Here, we wrap up this article by providing complete information on GST Suvidha Kendra. The initiative taken by the Indian government in this field has improved employment opportunities among youth and offers easy taxpayer assistance.