Key Takeaways

- Learning from the setbacks and grabbing the opportunities are signs of healthy small business practices.

- Prior to diving into additional expenditure, focus and prioritize the basic needs on which your business can thrive.

- When scaling up your business, maintaining revenue growth that outpaces expense growth becomes pivotal.

Running a small business is similar to orchestrating a symphony of ambition, innovation, and determination. Amid the melody of entrepreneurial dreams, financial harmony plays a pivotal role.

Just as an athlete fine-tunes their body for peak performance, a small business must achieve financial fitness to thrive, and besides using fillable document files like w2 form 2023, there are many aspects worth considering.

Think beyond mere spreadsheets—your budget is a navigation tool for your business. It offers a comprehensive view of your finances, revealing the allocation and potential waste of resources. A well-crafted budget not only forecasts expenses but also serves as a strategic blueprint for achieving vital financial milestones.

When navigating the unpredictable world of business, the key to stability lies in prioritization. Before indulging in optional expenditures, it is necessary to allocate resources to major areas such as operations, marketing, and personnel. By maintaining a balanced allocation, you can ensure a steady journey through both serene and turbulent times.

Speaking of a small business, obtaining the initial funding is like planting a seed. You have multiple avenues to explore for acquiring these funds: dipping into personal savings, seeking support from family and friends, or seeking out angel investors. Each investment opportunity carries its own set of conditions and consequences – therefore, it is significant that you thoroughly evaluate your options and select the one that best aligns with your overall vision.

As your business gains momentum, external investment becomes a lifeline. Venture capitalists, angel investors, and crowdfunding platforms beckon. Craft a compelling pitch, showcasing not only your product or service but your strategic prowess. Remember, investors don’t just fund your idea; they invest in your ability to execute it.

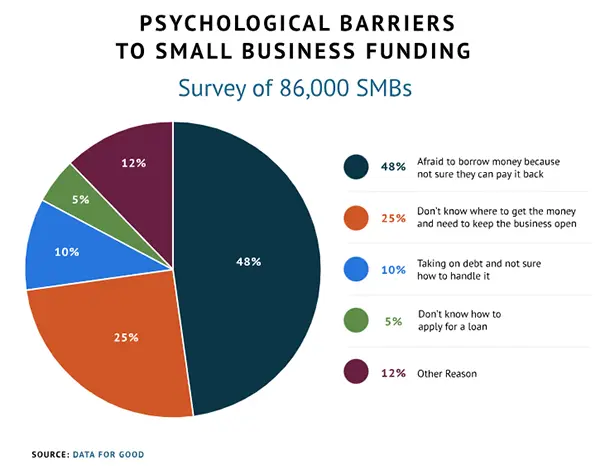

This graph shows the psychological barriers that most small business owners face while gathering funds. A massive 48% of people hesitate due to their own psychology and fear.

Pricing is an intricate dance that balances perception, competition, and profit margins. Underpricing may attract customers but erode profits; overpricing might alienate your audience. Research your market, analyze costs, and price your offerings strategically to strike the right chord between value and affordability.

In order to achieve business success, expansion is imperative. Yet, this must be accompanied by prudent financial management. When scaling up your business, maintaining revenue growth that outpaces expense growth becomes pivotal. To achieve this, one can consider investing in cutting-edge technology, finding ways to optimize operations, and forming strategic partnerships that leverage economies of scale when maintaining profitability.

Like a medical check-up, frequent financial analysis is vital: monitor cash flow, track key performance indicators (KPIs), and assess the return on investment (ROI) of your initiatives. Recognize patterns, identify bottlenecks, and pivot as needed. An agile approach ensures your business stays attuned to market shifts.

Technology has revolutionized financial management in the digital era: With accounting software, cash flow trackers, and data analytics platforms at your disposal, you can access real-time insights. This enables you to make quick and informed decisions during the time when uncovering hidden growth opportunities that might have gone unnoticed otherwise.

Successfully managing the financial aspect of a small business is more like participating in a marathon than sprinting. As you embark on this journey, it’s paramount to have patience and persistence by your side.

Celebrate the smaller victories along the way, and use any setbacks as learning opportunities, all when staying dedicated to your overall vision. Keep in mind that true success is built upon continuous efforts made consistently over time.

Just as a symphony harmonizes various instruments into a melodious whole, financial fitness orchestrates the myriad elements of budgeting, funding, and profitability into business success. It’s a dynamic equilibrium that requires your constant attention and adaptation.

By mastering these symphonic elements, you’ll be poised to not only weather challenges but also compose your own thriving entrepreneurial masterpiece.

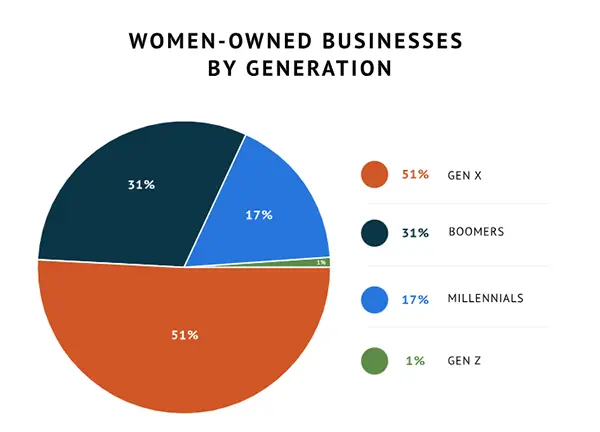

This interesting pie chart shows the percentage of females involved in small businesses based on their generations. Gen X clearly seems to dominate with a massive 51% contribution.

One thing you shouldn’t forget about – the pursuit of financial fitness shouldn’t come at the expense of your well-being. The demanding journey of entrepreneurship can take a toll on mental health and work-life balance.

Prioritize self-care, set boundaries, and seek support when needed. A healthy and resilient entrepreneur is better equipped to steer the business through challenges and make sound financial decisions.

Financial fitness plays a significant role in the captivating journey of small business. It is not just a momentary pause, but rather the steady beat that sustains the entire melody. As you maneuver through the symphony of budgeting, funding, and profitability, always keep in mind that achieving financial harmony is not an elusive note to chase after.

Instead, it is a collective effort akin to conducting a symphony with skill and foresight. When done right, this harmony has the power to transform your aspirations into remarkable accomplishments.