Has it ever felt like the usual financial options were limiting how you could do your business?

Well, you’re not alone, many business owners feel the same.

But, it’s 2025 and the world has gone almost all digital today.

The world has moved on from all those boring, paper-filled offices and stiff bank appointments to a vibrant online ecosystem.

The best thing is that it’s not just convenient, this digital transformation is also creating new ways for businesses to make money.

From customized loan offers to lightning-fast fund transfers, this digital arena is opening doors in ways that old-school methods could only dream of.

So, let’s take a look at how this digital revolution is creating new financing opportunities for small businesses.

Did it ever feel to you that the way of getting loans traditionally is as slow as snails?

Well, the digital switchover has taken care of that and much more.

Today, the whole loan process is not only faster and smarter.

It’s become more flexible, too.

This means that you have a ton of options to manage and repay them.

But what does this digital switch mean for your business?

DID YOU KNOW?

In 2023, the SBA provided $27.5 billion through more than 57,300 7(a) loans to small businesses. Nearly 70% of those were loans of $350,000 or less, the SBA reports.

When you think about keeping up with the financial needs of your business, there is no one-size-fits-all option.

The switch to digital can help you by giving you access to better and more accurate financial products that you might need.

The algorithms now have the ability to take a dive deep into your business insights.

And the result will be that you will see more financial solutions that suit your business’s needs.

Well, all businesses need financial aid from time to time and it is pretty hard to make comparisons between companies and options.

Today, online comparison sites and financial coaches have made it a lot easier for companies to make better financial decisions.

With these digital platforms, small business owners can sift through a sea of complicated financing options and products faster than you can say “interest rate.”

Want to choose an SBA loan or line up with some alternative lenders?

These sites lay out the pros and cons and let you filter options to meet specific needs—no guesswork is needed.

Today, many good financial firms have moved completely to the online space.

This means that you can easily find services like crowd-backed loans, flexible lines of credit, and merchant cash advances all on the Internet.

One of the many key advantages of shifting to digital platforms is that it streamlines the whole procedure of gaining access to financial services, along with offering novel ways to manage them efficiently.

One option of financial services draws significant attention towards itself: merchant cash advances (MCA). If you are one of those who are interested in gaining more insights on this option, you must research how to get out of MCA loans and other aspects as well.

This way, you can find useful strategies and advice on managing and repaying these advances.

So, if you skip out on a simple online search, you might just miss out on some pretty great deals.

You might have heard of the concept, that time is money.

This is pretty much a fact for many small businesses.

Today, everyone wants things to be done quickly, and this is especially true for matters of money too.

Many digital lender services have simplified their loan application process and businesses can see money hit their account in just a matter of minutes.

This expedited funding is a game-changer for small businesses.

Because there is no need to have a physical office, many financial services can now offer better deals to their customers, which are at significantly lower interest rates.

This cost-saving perk lets small businesses reinvest savings back into their operations.

These digital financial services act as lifelines for small businesses that are trying to make it in the business world.

Modern lending services understand that one plan that suits all kinds of repayment plans will not be able to suit the needs of small businesses.

Businesses of today need great plans that are flexible to their unique needs.

From adjusting payments according to seasonal sales spikes to allowing early settlements without penalties, these personalized repayment options are like having a Swiss Army knife in your pocket.

In the past, all the banks needed to confirm your creditworthiness were your credit history, income statements, and a firm handshake.

But in the present scenario, these institutions dive even deeper into your business.

Using everything from social media analysis to real-time business data, these companies use all the tools in their arsenal to figure out your business’s true value and financial health.

This means that your company will get a deal that is more in line with its financial needs and business model.

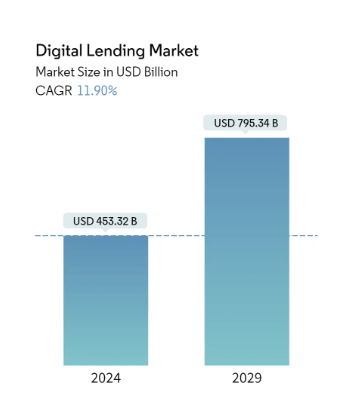

The Digital Lending Market size is estimated at USD 453.32 billion in 2024, and is expected to reach USD 795.34 billion by 2029, growing at a CAGR of 11.90% during the forecast period (2024-2029).

The digital transformation has brought great ways to help give your small business the boost it needs.

You need to look past the old ways and embrace this technological revolution if you want to grow your company even further.

From custom-made plans to match your financial needs to giving you more innovative and new ways to pay your loans back, these digital solutions can only bring great benefits to you.

It’s the adoption of tech by companies to improve their efficiency, value, or innovation.

It allows small enterprises to get their business processes up to date, speed up their workflows, strengthen security, and increase profitability.

It can help improve the customer experience by allowing customers to communicate with the financial department more effectively and conveniently via self-service options.

Online banking, online payment, and transfer services, as well as peer-to-peer lending personal investment advice, and other services.

They are a broad range of financial services accessed and delivered through digital channels, including payments, credit, savings, remittances, and insurance.