Key Takeaways

- By cross-listing, companies can gain access to a variety of investors and increase their visibility on the global stage.

- The New York Stock Exchange is the largest stock exchange in the world by market capitalization, providing companies with access to the bigger picture when it comes to investments.

- AI-powered systems can assist in regulatory compliance by ensuring that companies adhere to the listing requirements of different exchanges.

In the current globalized demographics, cross-listing has become an immensely hot strategy for companies looking to expand their reach and tap into new sources of capital. This article explores the role that AI, or artificial intelligence, plays in facilitating it in global markets.

Cross-listing refers to the process of listing a company’s shares on multiple stock exchanges around the world. This way, companies can gain access to a bigger audience and increase their visibility on the global stage. This can lead to higher liquidity, improved access to capital, and enhanced credibility for the company.

When a company decides to cross-list its shares, it opens up new avenues for a brighter future. Through tapping into international markets, companies can diversify their investor base and reduce their reliance on a single market or region. This can be particularly beneficial for companies operating in industries with a global presence or those with international expansion plans.

One of the chief advantages is the ability to attract investors from different countries and regions. This not only provides a broader range of potential shareholders but also allows companies to tap into the expertise and resources of investors from diverse backgrounds.

Having a diverse shareholder base, companies can benefit from different perspectives and insights, which can contribute to better decision-making and strategic planning.

Another significant benefit is the chance for a higher valuation. Companies listed on multiple stock exchanges may enjoy a higher market capitalization compared to those listed on only one exchange.

This can be attributed to the better transparency and accountability that comes with being listed on multiple global exchanges. Investors tend to perceive cross-listed companies as more trustworthy and reliable, leading to higher demand for their shares and might be driving up their market value.

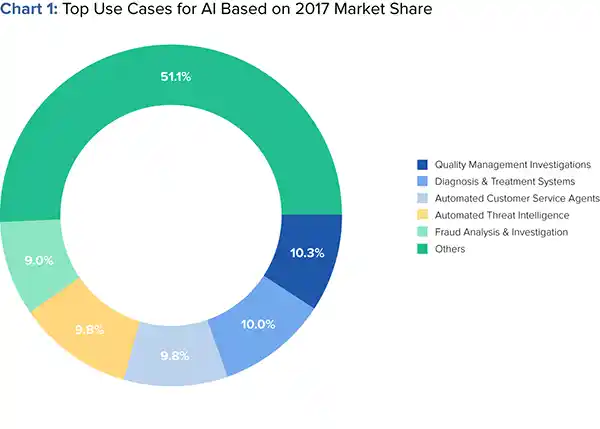

The chart below shows the data for 2017 in which the top uses of AI in the banking and financial sectors are reflected.

Global Markets, such as the New York Stock Exchange, the London Stock Exchange, and others, have a key involvement in facilitating cross-listing. These markets provide a platform for companies to list their shares and connect with a wide range of domestic and international investors.

Once the listing on global markets is done, companies can benefit from the deep liquidity and extensive investor base that these exchanges offer. The New York Stock Exchange, for example, is the largest stock exchange in the world in market capitalization, providing companies with access to a greater number of interested people who are ready to put their money at stake. This can result in increased trading volumes and improved price discovery for the company’s shares.

In addition to the financial advantages, being listed on a reputable global exchange can have a positive impact on a company’s corporate governance practices. Global exchanges often have stringent listing requirements and regulations that companies must adhere to.

These requirements promote transparency, accountability, and good governance, which can instill confidence in investors. Meeting these standards can enhance the company’s reputation and attract a wider range of buyers who value strong corporate governance.

Moreover, global markets provide companies with exposure to international audiences who may have a deeper understanding of specific industries or regions. This can be particularly valuable for companies operating in niche markets or those seeking to expand their operations globally.

Once connected with all the shareholders, companies can tap into their expertise, networks, and resources, which can facilitate maturation and evolution in new markets.

In conclusion, cross-listing on global markets offers numerous benefits for companies, including access to their stakeholders, increased liquidity, improved access to capital, and enhanced credibility.

The markets worldwide have a major contribution in facilitating the process, providing a platform for companies to connect with domestic and overseas buyers. Expanding its presence beyond a single stock exchange can unlock new opportunities for a brighter future, ultimately contributing to its long-term success.

Artificial intelligence has rapidly advanced in recent years, revolutionizing various industries, including finance. These technologies, such as machine learning and natural language processing, have been applied to tasks ranging from algorithmic trading to risk management.

In finance, it has the ability to analyze vast amounts of data and identify patterns and trends that humans may not be able to discern. This can lead to more accurate predictions, better investment decisions, and improved risk management strategies.

The applications of Artificial Intelligence in financial markets are massive. AI-powered trading algorithms can execute trades at high speeds, leveraging complex models and data analysis to capture market inefficiencies to generate profits.

AI is also being used in portfolio management to optimize asset allocation and improve portfolio performance. If historical data and market conditions are analyzed in real-time, systems can suggest optimal investment strategies and rebalancing actions.

Speaking of cross-listing, Artificial Intelligence can play a major participation in making a decision. The algorithms can analyze various factors, such as market conditions, regulatory requirements, and investor preferences, to determine the most suitable stock exchanges.

If AI, companies can lead to more viable conclusions regarding their strategy. It can assess the potential benefits and risks associated with it on different exchanges, taking into account factors such as market liquidity, listing fees, and reporting requirements.

In the intricate world of global markets, the accuracy and speed of data analysis become paramount. Here, the innovative realm of Immediate Edge comes into play. Many financial experts and enterprises now prefer Immediate Edge’s system for its unrivaled capability to process vast arrays of market data instantaneously.

This quantum-powered model not only forecasts market movements with impressive precision but also aids firms in making timely and strategic judgments. With such advanced tools at their disposal, businesses can navigate the complexities of global markets with increased confidence.

AI can also simplify the process itself, making it more efficient and less time-consuming. Through automation, the system can reduce the administrative burden associated with, such as the preparation of legal documents and financial statements.

Moreover, AI-powered systems can assist in regulatory compliance by ensuring that companies adhere to the listing requirements of different exchanges. This can help companies navigate the complex regulatory landscapes of multiple jurisdictions and minimize the risk of non-compliance.

In recent years, the advantages of using technology in markets have come to light through the success stories of numerous entities. A notable global technology firm tapped into the power of algorithms to discern the ideal stock exchanges for its ambitions.

If grounding its decisions in data is done, this company will succeed in listing its shares on platforms with high liquidity and robust investment demand. The subsequent outcomes were evident in surging trading volumes, enhanced market presence, and a substantial uptick in company valuation.

Whereas AI can bring significant benefits to cross-listing, it is necessary to understand the possible challenges and limitations. Implementing systems requires careful planning, robust data infrastructure, and skilled personnel.

Companies considering implementation should ensure that they have access to high-quality data and high-end analytics capabilities. They should also be prepared to invest in training and upskilling their workforce to effectively utilize the technologies.

The future of AI in cross-listing looks promising. As its technologies continue to advance, companies will have access to more sophisticated tools for finding conclusions and process optimization.

AI may also enable companies to explore opportunities on emerging digital platforms, such as blockchain-based exchanges. These platforms leverage intelligence and distributed ledger technology to enhance the efficiency, transparency, and security of transactions.

Whereas the technology holds great potential, there are challenges that companies need to address. Privacy concerns, data security, and regulatory compliance are among the major challenges when implementing AI.

Companies must ensure that they comply with data protection regulations and safeguard sensitive information. They should also be transparent about their usage and address any ethical considerations related to the use of algorithms.

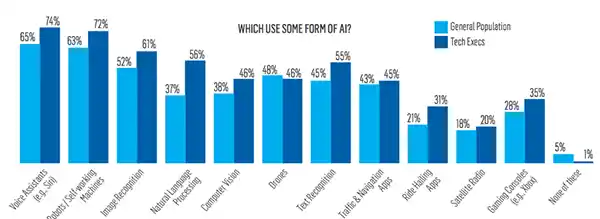

Here you can see the percentage of some form of AI in technology for both the general population and tech execs.

In conclusion, AI is having a major participation in facilitating cross-listing in global markets. If technologies, companies can make more informed decisions, streamline the process, and achieve enhanced market visibility. However, it is noteworthy for companies to understand the potential challenges and invest in the necessary infrastructure and skills to effectively leverage AI’s facilitating role in cross-listing.