KEY TAKEAWAYS

- Evaluating your current financial situation is important before making any major decisions.

- Financing options are helpful, but choosing the right one holds more value.

- Property situated at good locations are pricey but can be resold for a great price in the future.

- Taking help from experts like legal advisors and financial planners can streamline the entire process.

- After purchasing the house, individuals should look for ways that could increase its price further.

“The problem with real estate is that it’s local. You have to understand the local market.”

– Robert Kiyosaki (American businessman and author)

Buying a new property is a huge financial decision. It’s the dream of every human on Earth to have the most luxurious home money could buy, and they do try to make this come true, but often end up making small mistakes that lead to big chaos later.

Property value is also influenced by several factors, according to ResearchGate: the number of rooms, air quality, property tax rate, distance to employment centers, and highway accessibility affect housing prices.

Just so you don’t fall for any traps or make any stupid decisions, I’m here with a financial management guide, mentioning everything from budgeting to buying for property buyers. Let’s get started.

Before making such a big choice, it’s important to closely examine your current financial situation. Are you in a position where you can buy a new property without going into debt or messing up your other essential expenses? If not, it would only be the right decision to not go forward with it.

Several factors need to be considered before committing to anything: how much debt does a person have, what are their spending habits, do they have a gambling addiction or any loan that is yet to be completely paid.

Once these boxes are cleared and individuals think that they can still afford to make such a big financial decision, they should move forward.

There are many financing options available in the market, but settling for the right one is important. Fixed-rate loans provide stability and can be repaid on time without any additional charges, but variable-rate loans will fluctuate according to how the market is doing.

It’s important to consult a professional or visit any platform that can present all the products that match the needs of different individuals. Visit https://www.sofi.com/learn/content/how-to-set-financial-goals/ for more information on suitable loan products and financial tools.

I’ve seen people make one very common mistake that later messes up with their funds, and it’s that they only focus on the purchasing price, but that’s not the only thing that requires money. Other factors, like closing fees, legal expenses, maintenance charges, etc., come with ownership.

It’s essential to set aside a budget for other expenses and estimate them beforehand, so there won’t be any problems moving further. If a person doesn’t do so, they might have to pay hefty charges from their pocket, which would later mess up their finances.

Buying a property is a life-long commitment, you can’t just decide one day and be like I don’t feel like living here anymore because it doesn’t match my lifestyle and goals. Sure, you can do it if you are a millionaire or a billionaire, but a normal person with a steady income cant do that.

Buyers should be mindful of the location, like is the neighborhood premium with strong security and amenities. This matters as it will contribute to the resale value at the same time. If there are upcoming developments, zoning changes, and community expansion, this can also affect the property valuation.

Other things like what major cities can be accessed, is there an airport or any other transportation system nearby, most importantly what entertainment hubs are nearby. Choose a place that matches your day-to-day lifestyle and basic needs.

Professional guidance should always be taken while navigating the process of buying an estate. They carry deep knowledge on the subject and can give great assistance that would be useful and valuable.

Reaching out to legal advisors is crucial as they can pinpoint any potential issues with legal compliance that is getting violated and go through contracts to check if there are flaws or errors.

On the other hand, financial planners will help you get through the whole loan process. These professionals can also provide negotiating strategies that will get you favorable terms and solve all the legal, financial, and logical complexities.

High-end properties require appraisal and inspection because they are equipped with amenities and materials that wouldn’t be seen in any normal house. These properties speak luxury, and their prices are also through the roof.

Markets aren’t straightforward with the value and will only show the positive side, and people usually fall for this. That’s why a professional should be hired for appraisal and inspection who can tell everything regarding the property.

Structural assessments, environmental inspections, and evaluations of specialized amenities like pools or home automation systems should be done while examining the estate.

It doesn’t matter if a property is expensive or in budget, maintaining it can’t be avoided. However, luxury ones have expensive landscaping and specialized appliances that are costly to care for.

It takes dedicated planning to properly execute pool maintenance, security system updates, and repairs for elegant finishes. Individuals who own multiple properties and have busy schedules should hire a property management service.

A separate budget needs to be set aside for this maintenance, and this amount should only be used for residential upkeep.

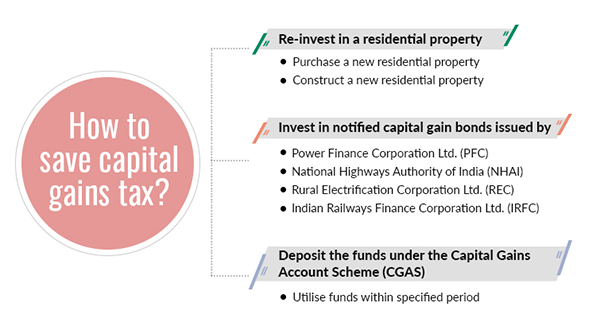

Tax implications and legal requirements are inevitable, but they aren’t the same everywhere and depend totally on the area the estate is in. Higher tax is usually put on luxury property, making it essential to understand property tax, capital gain taxes, and possible deductions. In the graph below, you can see how to save capital gain taxes.

If individuals are purchasing in a foreign country, several legal considerations are a must. This includes currency exchange regulations, ownership laws, etc., that would be applicable. Work alongside a legal and tax advisor to smoothen the process.

Settling for the first offer that you get is not the right move; instead, take a strategic approach. Do a proper research on the area and factor contributing to the property, market condition, and compare sales.

Once done, create an offer with all the terms mentioned clearly. Working with a skilled agent can improve the likelihood of securing a favorable deal while minimizing potential risks.

When everything is done and transactions have been made, don’t think that you can just sit back and relax. I mean, you can, but there are a few things that you can do. For starters, revisit your financial goals to be on track with loan repayment, potential resales, and upgrades in the future.

Property appreciation can also be increased with regular maintenance and renovations, keeping tabs on market trends, and looking for refinancing beneficial options. Lastly, maintain proper documentation of all the repairs and expenses done, as they are useful at the time of resale.

Home loan tenure shouldn’t exceed 20 years, the amount that you’ll pay every month should only be 30% of your income, and 40% of the cost of the house should be paid as a down payment.

While there are several factors, like amenities, total rooms, and other such features, the most crucial factor is location. Property at a good location often gives great resale values.

Residential, commercial, raw land, special purpose, and industrial are the 5 types of real estate that people reach out to.