Are you a policyholder? Do you find claiming your insurance a hassle? No worries, thankfully, with the introduction of virtual claim adjusters, changes are being made quickly within the industry.

It is important for the industry because it makes the process faster, saves money, and with the help of this, companies work more and make fewer mistakes. Using this can benefit in answering customers quicker and keeping things transparent and managed for their team.

Using a virtual claims adjuster makes every step easier, from collecting information and fixing claims. This amazing solution offers more flexibility, easy-to-track information, and can give real-time updates, which is not quite possible with paperwork.

Everything sounds so overwhelming, right? Don’t worry, read the article and understand how this tool is important for modern insurance firms and what their key benefits are.

KEY TAKEAWAYS

- Virtual claim adjusters are simplifying the work of insurance companies by gathering information and settling claims efficiently.

- It makes the whole process faster with digital submissions.

- This digital solution is also financially great for insurance companies as it cuts down the cost of travel, office space, and in-person visits.

- It improves customer experience as it offers more control and flexibility when customers report their claims.

- Working remotely also helps in dealing with emergencies like storms and floods, as the number of cases rises in these situations.

- It also helps the insurance information and other data to be more organized in one place.

This feature carries benefits to both the firms and the policyholder. As it makes the whole process faster and easier for customers, and it is less costly for firms. In addition, it helps companies keep their data more organized.

Virtual claim makes the whole process faster, through digital submissions, policyholders can report incidents online without waiting for a person to do the whole process.

With the help of this digital tool, insurers can instantly inspect photos, videos, and documents without wasting time on paperwork and travel. Automation can help in extracting the information from invoices, forms, and receipts.

This will help in minimizing the manual data entry, which will ultimately speed up the process, ensure accuracy, and save time.

One of the main key features of virtual solutions is remote collaboration. Insurers and policyholders can talk through phone calls, video calls, and messaging. Which helps in making decisions faster without beating around the bush. And this digital solution makes the journey of claiming insurance smoother for customers.

According to the recent surveys, this digital tool helps the firms deliver high-quality service while handling more cases than usual daily.

This excellent digital tool offers the policyholder more control and flexibility when they report claims. From the convenience of home, customers can file forms, upload documents, and schedule meetings online.

Some policyholders don’t want to wait for days to meet adjusters, especially when the incident is related to a serious situation. Digital adjuster makes this process less stressful by instant calls or online meetings. And this way, they don’t have to reschedule their work.

This minimizes interruption in their daily life, gives them a sense of control, and provides a more immediate, tension-free process. Research shows that faster support and instant feedback lead to higher customer satisfaction.

Since this tool comes in light, it significantly reduces the operational cost in insurance by streamlining the processes. Physical travel, office visits, and paperwork all require time and money, but these two can be saved with the help of digital adjusting in the firm.

For example, automation can help in data entry, document processing, and initial claim assessment, but if an insurer does it manually, it takes time and labor costs. Although human adjusters are required for more complex tasks, calls, and meetings but through digital adjusting, they can work from anywhere. This can save the cost of office space and travel expenses.

By using fewer resources, insurance companies can save money, which they can use in making the pricing more attractive for their customers.

This virtual feature count on digital records and automated tools, which help in cutting down errors and mistakes. When a report is entered, the system stores and checks the data if there are any mistakes or missing information.

Photos and videos that entered the system are reviewed carefully to check the evidence’s truth. This helps in making the decision faster and settling it quicker.

Records entered in the system are easy to store and easy to find, too, if there are any questions raised in the future.

DID YOU KNOW

The first known insurance contract was signed in 1347 in Genoa, Italy.

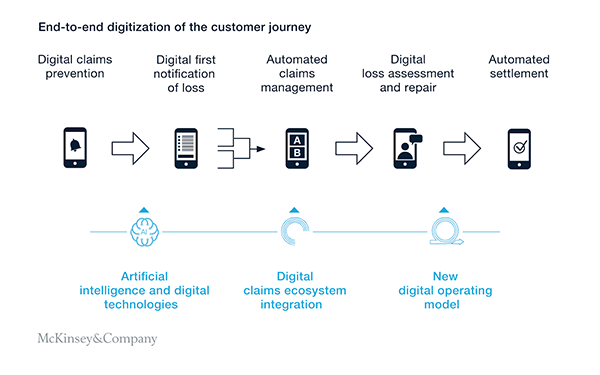

Modern technology helps build this incredible tool, and this is transforming the way insurance firms work. It changes the whole settlement process as it is now faster, easier, and more accurate.

Not only this, but it also helps companies operate from anywhere, use better data, and align with the rules, which are beneficial for both the policyholder and the company. Here are a few strategic impacts of this on modern insurance firms:

Using this digital tool, insurance companies can work remotely from anywhere. This cuts down the travel cost and makes the process faster, which benefits policyholders and firms both, as policyholders get an immediate response. This way, the insurance team can handle more clients during busy times without waiting for the in-person visit to finish.

It is very helpful and effective in emergencies like storms, floods, or disasters, earthquakes, where the insurance team needs to work fast, as numbers of case suddenly rise. Working remotely and virtually helps the firms reach every customer faster.

This digital feature uses AI and automation to help the insurance company make better decisions. During the settlement process, this gathers a large amount of data using a digital system.

It spots patterns in this data and predicts what claims will come in the future, and finds the way in which the claim process, finds fraud, assesses risk, and personalizes service, becomes faster and easier.

In addition, having all the data in one place can help in the future, too, if any problems or questions arise.

There are some laws that are made for customer protection. Insurance companies must follow these laws, like keeping personal details safe and private, being fair in how claims are decided, and paying the exact written amount.

Sometimes, there are different insurance laws and rules in different areas. In this case, Insurance companies set up automation systems to keep up with all the insurance and customer laws of the given area. Like how quickly a claim needs to be settled and what needs to be added in the final report.

Tracking and reporting tools make it easy to keep a record of settlements. Digital records help companies show their process clearly, which reduces the chance of making mistakes.

This virtual tool was introduced on a large scale during the pandemic, but after noticing its results and effectiveness, insurance companies are using it in their daily work.

It simplifies most of the steps, like gathering information, giving real-time updates, and finding fraud.

This digital solution is helping insurance companies grow faster and effectively in this era.

Investigating, evaluating, and settling claims are the most important responsibilities of a claim adjuster.

A virtual adjuster reviews, analyzes, and checks the authenticity of the claim.

Claim of fact, claim of policy, and claim of value are its three types.

Adjudication, submission, payment, and processing are a part of the insurance claim cycle.