KEY TAKEAWAYS

- There are two types of trading platforms: commercial and proprietary.

- Trading plaform software development takes a lot of time and investment.

- The UX/UI design matters as it retains users in the long run.

- AI trends will further enhance trading platforms.

- After launching the app, observe it clearly and make necessary changes to eliminate bugs and glitches.

The online trading platform market has skyrocketed in just a few years. According to statistics, it was valued at $10.15 billion in 2024 and would reach a staggering $16.17 in 2025. Showing its success and use among people for trading, eliminating the traditional method.

Modern trading platform software development has now become an important part of the economy and for people. These platforms make it easy for individuals to get in the market and do trades, but did you know how they are developed?

Don’t worry; I’ve got you covered and will uncover the trading platform software development process and other important things related to it. Let’s get started.

In general, there are two types of trading platforms. Those are:

The major difference between is that anyone can gain access to commercial platforms but in proprietary those who are connected to the company can do trading there and no one else.

Trading on online platforms comes with several benefits. This includes:

Trading platforms are equipped with features that make them the first preference of today’s traders. Starting with a user-friendly interface that makes it easy to access, the tools that are present can be learned over time; they aren’t complicated either.

People are met with diverse investment options and can invest in stocks, bonds, EFTs, mutual funds, forex, and more. It is equipped with analytical tools that help navigate market trends and make strategies accordingly. These tools often save users from heavy losses.

Customer support and portfolio management tools are always helpful as if there is any issue you can reach out for help. All the trades that were done will be stored in place so it could be shared or analyzed later.

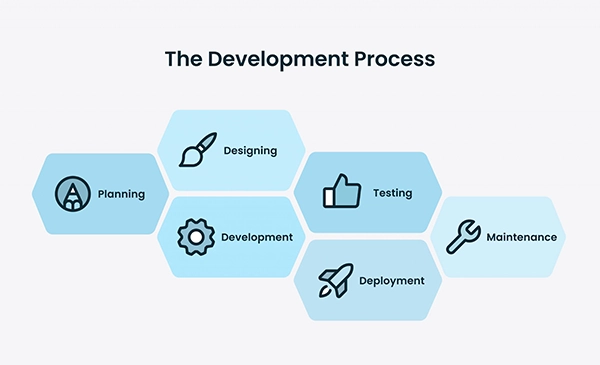

The development process of a trading platform is filled with complexity as various factors need to be taken into consideration. Like:

There are more steps, but these are the five most crucial steps that can be overlooked and need great attention and detailing. Below, you can see all critical steps that are used for establishing any app or site.

This is quite a common question: How long does it take to build trading platform software? There is no accurate answer as it completely depends on the complex features, size of the team being used for its making, changes that will be done later, problems that might arise while in the making, and so on.

But to give you an Idea, on average, it takes 400-2,400 hours or 3 to 18 months. The developer will give you the complete insights once they have understood your vision and the things you are looking for.

Trading platform future is as bright as it can be, and several new trends are going to become a major part. Integration of AI will make things easier for traders with its analyzing capabilities and making trades on user experience.

Mobile-based apps and sites would be advanced further as it is the first preference for retail traders. Zero commission and alternative revenue models are under development and will be available to use soon.

DID YOU KNOW?NAICO-NET was the world’s first online trading platform, launched in 1982!

Trading platform software development requires a lot of time to get ready, and there is still no guarantee if it will be perfect or not if you are taking help from developers who are still amateurs or don’t have a good reputation in the field.

It’s a major investment, so it’s crucial to invest in the right place without compromising the quality. If the app or site took it will help you make the double or triple of what was invested so make decisions carefully.

You can either reach out to a professional development service that will do all the work for you (but it will be costly) or start learning yourself, but it will take a lot of time if you do not know coding, UX/UI, designing, etc.

C++ is the developers’ recommended language for creating trading platforms because of its speed and efficiency. How much does it cost to build a trading platform?

The overall cost of creating a trading platform depends on various factors, but usually, it’s around $20,000 to $200,000.