KEY TAKEAWAYS

Markets are constantly in a state of uncertainty and flux, and money is made by discounting the obvious and betting on the unexpected.

— George Soros (American investor and philanthropist)

Trading holds the power to make someone wealthy overnight if done right. Not to mention, the size of the global stock market trading was estimated at $111 trillion. Some people have greatly contributed to it.

You can say they are heroes or the best traders in the world, but regardless, they’ve done great things and created names that have gone down in history. Today, people are looking up to them and walking in their footsteps.

In this article, I’ll be mentioning the titans of trading legends who shaped the financial world. Let’s get started.

George Soros is one of the most influential people in the history of trading. He was born in 1930, Hungary and is the survivor of Nazi occupation. His net worth is estimated to be $7.2 billion in 2025, but keep in mind that he has made $32 billion in donations to Open Society Foundations.

Not only is Soros a brilliant-minded individual, but he is also very kind-hearted. One of Soros’s greatest achievements to date happened on September 16, 1992, aka “Black Wednesday”

Soros bet against the British pound forcing because of this Bank of England were left with no choice but to withdraw from the European Exchange Rate Mechanism and devalue the currency.

While this caused a major crash, Soros Quantum Funds managed to make $1 billion in profit and earned him the title of “The Man Who Broke the Bank of England.”

From being born into a poor family to becoming the biggest day trader, Jesse Livermore is no less than a role model. Born on July 26, 1877, he was an exceptional child, being able to read and write at the age of three and a half.

However, because of the family’s financial background, Jesse’s father pulled him out of school at the age of 14 so he could come and help on the farm, but Jesse decided to run away with the support given by his mother.

He started working in bucket shops in Boston and made his way to the stock market. Livermore was known for his technical analysis, and because of that, during the 1929 market crash, he managed to make $100 million, and if we convert it to today’s price, it would be around $1.5 billion.

But Livermore finally killed himself on November 28, 1940. There are various reasons for this and some theories as well, one being his debt and not able to manage his personal life. Despite this, he stands strong as one of the most influential traders in history.

Paul Tudor Jones was the Jesse Livermore of the 19th century. He predicted one of the major global crashes, Black Monday, and was able to earn triple the amount of money invested and earned 200% by the end of 1987.

Jones was known for his adaptability and macro tradition strategies, and over time, he came up with the perfect way to leverage quantitative models and risk management techniques. Not to mention, he is quite strict; several reports surfaced that he fires traders who lose 10% of the assigned capital.

But because of this, he has managed to survive for decades. In 2022, it was reported that while his firm, Tudor Investment Corporation, is not able to get good returns, only 5% annual, they still have $12 billion worth of assets under management.

DID YOU KNOW?The issuing of stock and trading started in 1602!

People who said that mathematics can’t be used for trading, Jim Simons conquered the entire Wall Street, only based on data-driven strategies and mathematical models. Wait, I forgot to mention he was also known as the greatest investor on Wall Street.

At the time of his death on May 10, 2024, his net worth was estimated at $31.4 billion, and he was at number 55 on the list of the richest people in the world. Before opening his own company, Renaissance Technologies, he was a professor and code breaker for the National Security Agency.

Raymond Thomas Dalio, or Ray Dalio, is the founder of Bridgewater Associates, aka the world’s largest hedge fund with $150 billion in AUM. Ray was also ranked at number 124th on the world’s richest people by Forbes in December 2024, with a net worth of $15.4 billion.

Dalio has come up with his very own strategy known as “all-weather portfolios,” which can survive any economic environment as it is built by understanding the macroeconomic cycle.

This strategy has been helping him generate an annual return of 12% since 1991. This consistency is what attracted so many people. Dalio believes in sharing things, so others can grow and move forward.

He has published a book called Principles: Life & Work. It made its way to the New York Times bestseller list and has helped investors all around the world gain significant knowledge regarding corporate management and investment philosophy.

Trading isn’t a male-dominated field; Linda Bradford Raschke remains one of the most influential female traders on Wall Street. Linda started trading in 1982, and by 1992, she was a registered Commodity Trading Advisor (CTA).

Linda followed three things in her 4-decade career: performance, longevity, and consistency. She was the principal trader for several hedge funds until she decided to open her own in 2002 and took on the role of Commodity Pool Operator (CPO).

She changed quite a lot of things, and her hedge fund was ranked at number 17th out of 4500. Even after retiring in 2015, she is still trading daily now for herself and shares insights on social media.

The above-mentioned titans were known for not leaving the traditional ways and were involved in the market directly. But as time passed, new innovations have been introduced, one being online retail trading platforms.

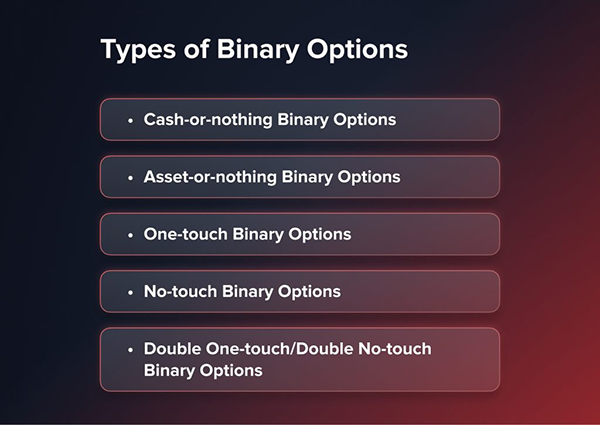

These allow individuals to buy and sell financial instruments like stocks, bonds, and cryptocurrencies. Another modern-day concept includes binary trading. It is also a form of trading where you have to predict where the price of any specific asset will go up or down.

However, the prediction needs to be within a set time. There are only two outcomes: you’ll either get a fixed payout or won’t get anything at all. It’s quite simple and does offer great returns, but sometimes it can be brutal financially, so be mindful. Below, you can see different types of binary options.

All these trading legends that were mentioned above shared a few common traits. It’s not like they were avoiding risk; they were taking it, but had built risk management strategies so they could function in the long run.

One thing that they never let go of was discipline, and in trading without it, you can’t achieve success. It’s also important to be adaptive as the market can change anytime, and these individuals were always ready for it.

The titans of trading brought a new revolution and made trading what it is today, as people are still following in their footsteps. Now we have taken up a more digitalized approach, but it’s safe to say that it is going to be enhanced further.

Trading means great risk but great rewards, but it doesn’t mean being careless. You can learn more about these legendary traders and see how they used to do it, and create a strategy of your own.

George Soros is considered to be the most successful trader of all time. He had a net worth of $7.2 billion and donated over $32 billion.

Charles Dow, the founder of the Wall Street Journal, is usually considered the father of technical analysis.

Momentum trading and swing trading are considered to be the most profitable. It creates the perfect balance between risk and reward.