The indispensable steps to set up your crypto trading bots and test them under certain market conditions.

Key Takeaways

- >You can set parameters on your crypto trading bot to automatically buy or sell cryptos with a great deal.

- These bots are recommended by traders who have been active in the market for more than 10 years.

- You can find some bots on Telegram as well. Some of them are listed below:

- Cornix

- Coinmatics

- Trality

- Quadency

- CoinCodeCap

Your analysis of trading and investments is one of the best ways to unlock potential profits, crypto bots can assist your journey very well. They are available to make the best moves.

On your behalf, the robots use their existing knowledge to buy or sell cryptocurrencies and maximize the chance of securing huge profits. More to that, you may feel encouraged to know that many experienced traders use them as their assistance to come up with well-knowledged options.

On top of the key steps to setting up and using a bot, you must prioritize choosing the right one. Make sure you decide on the best crypto programs to start a fabulous journey.

It is a step strongly recommended by many traders who have been in the cryptocurrency marketplace for more than 10 years. Moreover, various bots are available on the internet, but the trick lies in picking the one that fits your strategies or ideal parameters. With the right program, you will find new confidence in online platforms and a stress-free experience.

Once you have selected your cryptocurrency bot, it is time to make an account on the platform and connect it to a cryptocurrency exchange like Kraken, Binance, or Coinbase Exchange. During the setting up of your crypto robot, you will be asked to specify key parameters such as the trading pair, trade size, and risk management settings.

They also root for your configured technical indicators and strategies that they will follow. These might be Bollinger Bands, moving averages, or other indicators that fit your preferred approach. Understanding the importance of each parameter and how it affects the bot’s decision-making is vital.

In addition, you also need to set up appropriate security measures, including two-factor authentication (2FA) and utilizing secure API keys. This will ensure the protection of your crypto bots and funds.

Tip: Machine learning is considered a better option, as it has been observed that platforms based on ML perform better than those of statistical and econometric models.

The following points may help you to define your strategy for robots:

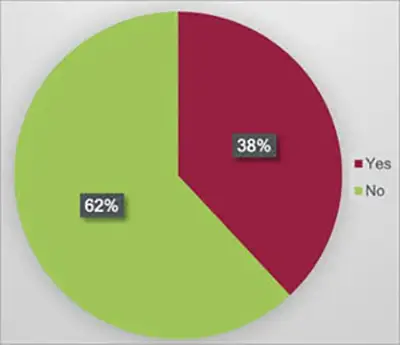

This graph shows how only 38% of crypto users use crypto bots for trading. But the fact is that almost 86% of money movement in the market is done by bot users.

The trading space entails risks even if you have a plethora of experience. When you choose the top platform for yourself, you can manage such risks and opt for plausible profits. If you are a new trader or an investor in the crypto space and are mostly unaware of the concept and its workings, secure crypto trading bots may be the right one for you. Below are some steps to consider regarding setting stop-loss and take-profit levels to manage your risks.

Tip: You can find these crypto bots on Telegram as well. You can search for them on Google, or you can just try one from this list.

Cornix

- Coinmatics

- Trality

- Quadency

- CoinCodeCap

Once the parameters and indicators are set for your bots, you can test their performance in a simulated environment. Use data from previous years to assess their performances under various market conditions. Testing robots for crypto allows you to evaluate the bot’s ability to execute trades accurately, respond to market changes, and manage risk.

Moreover, backtesting is also noteworthy, as it is all about examining the crypto dealing bot’s performance in light of previous market data to forecast its prospective profitability and pinpoint areas needing development. Through the outcomes, you can change the parameters of the program for crypto, improve your tactics, build trust in their capabilities, and make wise judgments.

One suitable example for backtesting is 3Commas. It is a popular option that offers a backtesting feature. According to reviews, this renowned bot not only offers a backtesting feature but also receives positive feedback from users.

After the testing of your programs, you need to monitor them and make adjustments when required. It is necessary to optimize them for the changing market scenarios. Regular monitoring includes tracking the bot’s transactions, evaluating its profitability, and spotting any possible problems or departures from your intended plan.

You can also find areas for improvement and make the required corrections by observing the real-time market data and the bot’s performance indicators. In addition, keep yourself updated with the latest news and trends to proactively adjust your bot to align with the evolving market dynamics.

The key steps are followed by many experienced crypto traders, and if you are new to the space, consider them. Crypto dealing bots have revolutionized the arena, facilitating the journeys of many investors. From choosing the right cryptocurrency programs to adjusting their parameters and indicators, ensure the potential for the most profits. Keep yourself updated with the latest updates on niches and adjust them accordingly to get the best performances from them.