A short-term business loan, or short-term commercial loan is a typical yet unique type of debt that startups often go in their needy situations. In this era of growing startups and ventures, capital needs have gained more than ever. It is obvious that all of the new ventures need a heavy amount of capital in their accounts (in some exceptional cases, businesses need minimal capital investments).

In order to let the organization not only survive but thrive, the chief bodies decide to go for short-term lending. These lendings are a great alternative for these ventures to feed greens for their operations or to cover a cash flow gap. If you have studied finance or even carry a basic knowledge of it, you must know that the deals that carry tenure for less than 12 months are considered short-term. Similarly, these lendings are offered with a lifespan of less than 12 months. You will understand the funds and grants of the small business.

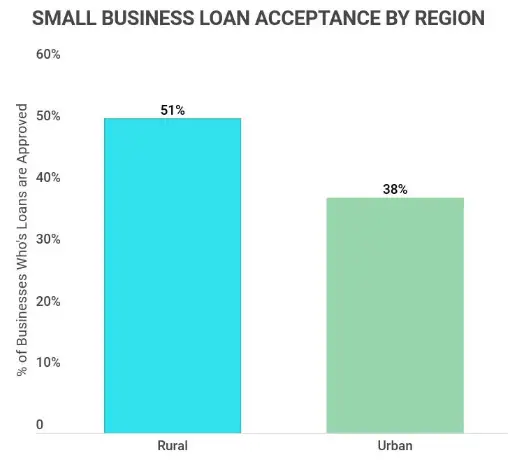

Surprisingly, a fact that rural areas are ahead of urban areas in terms of applying for these loans. Which is providing them with an equal chance to seed money for their small ventures. Various government schemes and even private entities are coming forward to boost this initiative and reduce income inequality in society.

If you are a business owner, it reason behind following this article holds a huge significance for your success. Or even if you’re not, you can follow this amazing piece of writing for your knowledge in the world of finance.

This type of commercial lending is different in that it:

A working loan is needed to invest in something that will quickly pay off:

The short term business loans amount is calculated individually and depends on the turnover of the venture. When calculating, the bank takes into account the turnover on all customer accounts.

There are many organizations out there who are eager to lend you some amount for a good interest rate on which you both can agree. Each lender has its own eligibility criteria.

Although, there are some basic things you need to practice before making a final decision.

If an individual entrepreneur or organization has been operating for less than three months, then they cannot yet provide reporting on turnover. To protect yourself from a bad deal, the bank can offer a value on the individual term

Like any banking product, revolving debt has its pros and cons. It is important to consider them in order to make the right choice.

The advantages include simplified conditions for issuance. The bank does not require liquid collateral and justification for what the money will be spent on.

The downsides are the high-interest rate and short lending term compared to other types of banking products.

A working debt or loan helps individual entrepreneurs and organizations to improve financial stability and support the processes. But the venture owner must have a clear plan based on actual numbers and facts. He must understand how to spend borrowed funds so that the estimated revenue not only covers all expenses but also allows the venture to become profitable. For this, you need to consider:

If after settlements with the bank and payment of all payments, the entrepreneur receives the amount of profit he needs, then borrowed funds can be taken.

Here are a few cases where a short-term debt is not worth taking: