Keeping your finances in check is essential for everyone, it doesn’t matter whether it’s an organization or personal. By keeping your finances in order you’ll be able to see where you are overspending, how you can save more etc.

Benjamin Franklin once said, “Beware of little expenses. A small leak will sink a great ship.” Your finances will help you with monitoring all your expenses, but how can you do it yourself?

We are living in the 21st century and now there is a software for most of the things. So, there are software programs that would help you with keeping your finances organized. But which one is the best, and how to choose the one that aligns with your needs and goals?

Worry not, as In this article, we’ll uncover the best personal finance software that you should take into consideration in 2025.

So, without any further ado, let’s get the ball rolling.

Using a mobile application to control your finances is a great way to track your transactions, understand your expenses, and improve your spending habits. It can be a great tool if you want to save for a particular purchase like a car or a new phone.

Financial planning solutions combine manual transaction recording and automatic synchronization between your mobile banking, crypto wallet, and investment apps. This way, the planner app can streamline your funds in one area to easily overview, manage, and analyze.

If you are in debt or anything, this could you manage that as these apps come with debt management features. Finance apps also save you time because you can do things on your own and in your comfort place without relaying or going anywhere.

Some personal finance apps will also help you do your taxes, which will save you money since you won’t have to hire an accountant. Overall, finance apps are reliable and come with amazing features.

DID YOU KNOW?

The U.K. was the first country that started online banking in 1982!

When searching for a financial planner, you will find hundreds of applications that serve the same purpose. However, they work differently. Some focus on the user experience, while others provide detailed analyses, control tools, and convenient navigation.

But you have to find the one that suits you best, and we have made a list of the three best apps that have everything you can ask for.

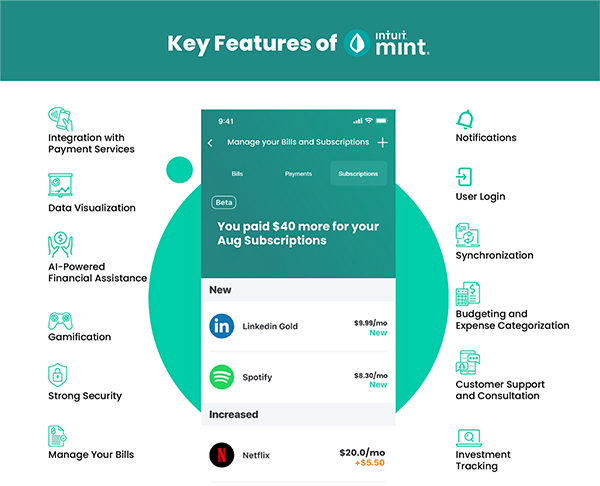

The Mint Financial Planning app provides an easy-to-use interface that you’ll understand quickly. With organized layouts where you can easily find and switch between functions and utilities.

You can integrate the Mint app with your banking app or credit card issuer to streamline your monetary operations. Find sophisticated budgeting tools, control payment notifications, monitor credit scores, and create your saving targets.

Mint focuses on users with straightforward needs, such as journaling and tracking. If you are someone who is not good at handling complicated software, this app is perfect for you.

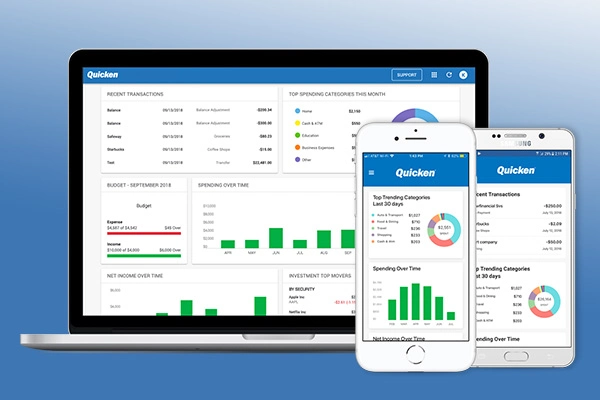

Quicken is an advanced financial planner that provides various cost-tracking tools. You can find comprehensive money management features like budget creation, bill management, portfolio analysis, and retirement planning.

These functions make it easier for you to locate and control your spending from one dashboard without switching between multiple apps. It’s like a one-stop shop for all your needs.

If you require a simple way to record and track your expenditures. In that case, Quicken allows you to register your payments, classify them into different categories, and view them in your monthly report. The app is available for Android and IOS both.

You Need a Budget is an advanced financial planning tool that focuses on budget creation, customization, and tracking. Its straightforward approach allows novice users to set a budget for their different needs.

You can link the YNAB app with other financial apps on your phone, like mobile banking and digital wallets, to streamline your finances. Additionally, you can set one or more goals, control your debts, and track your spending in real-time. This app is also available for Android and IOS both.

YNAB is better for more hefty work but managing things on this platform won’t stress you out, and you’ll be able to handle things without too much difficulty.

Controlling your finances using a personal planning app is a smart way to reach your goals. Whether you want to invest your money, control your savings, decrease waste, or track your monthly costs, these apps will help you.

You can strategize and set your budget, control your debts and bills, overview your transactions, and track your performance with various 3rd party integrations.

But still, keep these apps password-protected and private, you don’t want your finances to get leaked, right? So take good measures. Rest these apps are meant for your convenience and comfort, so take full advantage of them.