The gold loan market in India is experiencing significant growth due to an increase in inflation, as well as an increased tendency of individuals to have quick access to funds.

Gold, a cherished asset in Indian households, is increasingly recognized as a reliable source of liquidity, allowing borrowers to put it up for a loan without selling it.

Companies like Muthoot Finance have been leading the way in this sector and organizing gold loans in the above manner.

Take a step back and read this blog as we will try to understand the key trends behind this rising trend and what it implies for the borrowing scenario in India.

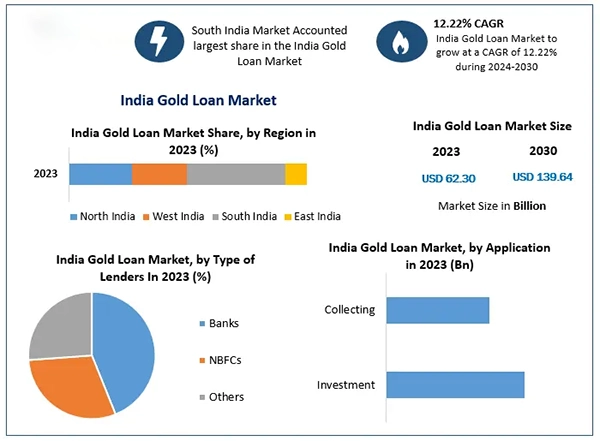

India has seen a tremendous upsurge in the international lending market, and this rage, which is popularly described as a ‘Gold Rush’ is a clear illustration of various factors interacting that have facilitated the industry reach an unimaginable level of development.

Due to the increasing prices of gold, people have started finding it more and more beneficial to use their gold as security for loaning money.

The very fact that gold is placed as security, encourages lenders to provide such loans, as it reduces the risk.

This advantage is another key factor contributing to the rising market of Gold loans.

As Indian society progresses economically and sociologically, the gold loan sector can be expected to also continue growing and so new innovations would come up with the market.

So far in 2024, gold prices have risen nearly 23%, with a 35% increase over the past year.

Hence, as the field continuous to improve, here’s this table describing key trends in the gold loan market:

| Trend | Description | Impact on Market |

|---|---|---|

| Increasing Competition | More players entering the market | Better rates and services for consumers |

| Digital Transformation | Online platforms for gold loan applications | Enhanced customer experience and accessibility |

| Awareness Campaigns | Financial literacy programs targeting gold loans | Increased understanding and adoption of gold loans |

| Regulatory Changes | Easing of regulations for NBFCs offering gold loans | Boosted market confidence and lending capabilities |

Technology has evolved drastically, so much so that its use has changed the gold loan industry completely.

Most borrowers do not have to leave their homes anymore, as it is possible, due to the presence of web portals, to submit requests for loans even from the websites.

There has been a decreasing curve in the time taken for various types of loans to be approved and disbursed thanks to this movement.

Muthoot Finance, for example, has incorporated digital initiatives to improve the customer experience, making gold loans more accessible and user-friendly.

They have integrated various digital tools to ensure customer convenience:

Chat & WhatsApp Integration

Muthoot – Mobile Hub for Convenience

Digitized Customer Onboarding

Digital Payments

Diverse Payment Channels

Efficient Loan Identification through Virtual Account Numbers

Holistic Digital Wallet Integration:

There has been a considerable enhancement of gold loans in India as one of the financial service methods where people can borrow money without parting with their gold.

Gold loaning as security for cash is influenced by various macroeconomic factors.

In this piece of analysis, three areas are explored in detail: the impact of increased prices of gold, customer preferences and behavior, and the future of gold loans in India.

An increase in the price of gold in India may have an effect on various aspects of the economy and the buying patterns of the people.

On the positive side;

On the negative side;

Gold has been deeply ingrained in various aspects of Indian culture and society for centuries, mainly because gold in India is considered sacred.

The metal increased in demand and value when more and more people became financially knowledgeable and learned about the benefits of gold loans.

They found it as their best assistance in times of financial crisis and when things are getting expensive in the country.

India seems ready for yet another positive growth and that is on Gold Loans.

As more and more people are making themselves financial knowledge and understanding the benefits of Gold loans, there will be rapid growth in the market of Gold loans, attracting customers from both rural and urban areas.

As a financial company like Muthoot Finance incorporates updated features, the customers can easily proceed with the loan procedure and can track their payments.

All in all, the gold loan segment in India is forecasted to witness growth in the near future.