In a world of technology and finance, fintech innovations are not just changing the game – they’re changing its face.

If you have been keeping an eye on new and modernized trends in the financial sector, there are chances you must have come across this outstanding service called embedded finance.

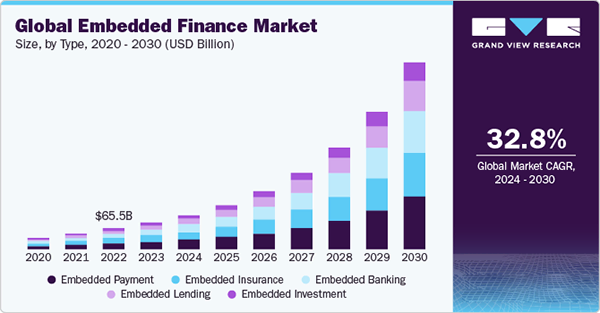

The cost of this project has been estimated with a market value of over $138 billion by 2026 and a projected global value of $7 trillion in the next decade.

That statistic makes it absolutely clear that this isn’t just some short-lived trend, but it’s an honest-to-goodness deal.

In this article, we’ll delve deeper into embedded finance and will uncover what makes this innovation a groundbreaker and will also know its significant role in the financial industry.

Embedded finance is the integration of financial services into non-financial platforms or applications

The service refers to providing financial services within the ecosystems of other industries.

This innovation provides consumers with the ability to get financial products in a more functional way without the need to go to a specific financial institution.

Also, companies now can offer their customers a more engaging and efficient service by embedding all the necessary financial options directly into the apps or websites the customers are using.

This means consumers can access these services within familiar apps or websites, bypassing traditional financial institutions.

For example, a ride-sharing app could offer built-in financing options for users to purchase a new vehicle, or an e-commerce platform might provide instant loans to help customers make larger purchases.

This trend can potentially revolutionize how consumers interact with economic services, making them more accessible and integrated into their daily lives.

In recent years, Embedded Finance work has seen a sudden and large increase in popularity, fulfilling the demand of customers seeking faster and more convenient services in payment methods.

The service seamlessly integrates financial services, such as lending, payments, insurance, and banking, into non-financial platforms.

So how exactly does it work?

Application Programming Interfaces (APIs) enable the integration of economic services into non-financial platforms.

They allow organizations to seamlessly incorporate services like lending, insurance, and payments into their existing digital platforms.

For example, a digital wallet integrated into an e-commerce site allows users to make payments directly without leaving the platform.

A Buy Now, Pay Later (BNPL) service can be integrated to offer flexible payment options, and in a trading platform, APIs from banks or payment processors enable users to transfer funds directly to their trading accounts.

Do You Know?

The embedded finance market is estimated to be worth USD 115.8 billion in 2024.

Embedded Finance is no longer hidden, therefore, more and more finance institutions and businesses are turning to it, utilizing its several key benefits that give them a competitive edge in the market and drive growth and profitability.

Here are the visible advantages of embedded finance:

Key technologies that drive Embedded Finance include:

As technology continues to advance, we can expect to see even more innovative applications of embedded finance.

For instance, Embedded finance platforms may be able to offer highly personalized financial products and services based on individual preferences and behaviors.

It can make economic services more accessible to underserved populations, such as those in rural areas or with limited credit histories.

Financial services could be integrated with Internet of Things (IoT) devices to enable automated payments and financial management.

As embedded finance becomes more prevalent, there will be a need for robust security measures to protect user data and prevent fraud.

Embedded finance is a rapidly evolving field with the potential to revolutionize the way we access and manage economic services.

By understanding the benefits and technologies driving this trend, businesses and consumers can stay ahead of the curve and reap the rewards of this innovative approach.

As embedded finance continues to develop, we can expect to see more changes, more convenience, and better financial solutions.