KEY TAKEAWAYS

- Accounts should be chosen based on capital, trading experience, and strategy needs.

- Balanced features with moderate spreads are offered in standard accounts.

- ECN accounts provide tight spreads with separate commission for advanced traders.

- Make sure to check strategies on a demo account first.

- Swap-free accounts meet Islamic finance rules to avoid overnight interest charges.

Have you heard about trading accounts, and what do they do? It is like an investment account that consists of cash, securities, and other such holdings. Every broker an investor has a trading account, but which one is best?

Whether you are just testing the water or going to take a deep dive into the world of trading, you have to have a trading account. Without it t you won’t be able to function well.

So, to make things easier for you, I’m here with an article comparing account types and conditions offered by brokers. Let’s get started. Before you rush to complete a login metatrader 5 setup, or fund your first account, let’s compare the options and find the one that fits you best.

Usually, brokers categorize their offerings into a few account types. These are the most common ones and are used globally. This includes:

These are:

Each has distinct features, and some brokers—especially in regulated regions like broker forex Indonesia — may also apply local compliance rules and conditions.

It is treated as a default option for most of the retail traders, and is used quite a lot.

Common characteristics:

Best for: If you want a perfect balance between functionality and simplicity, this is for you.

In this account type, everything is done in cents and not base currency units, making it less risky. It’s perfect for trying out new strategies.

Key features:

Best for: Beginners, or those who want to transition from demo to live with minimal risk.

Traders are directly connected to liquidity providers via ECN or a raw spread account. Here, execution is fast, and full transparency is maintained along with tight spreads.

Typical conditions:

Best for: Experienced traders, scalpers, and algorithmic trading users logging in via Meta Trader5.

Offered by brokers in regions with large Muslim populations, such as Indonesia, this account complies with Islamic finance rules.

Key conditions:

Best for: Traders requiring non-interest-bearing account structures.

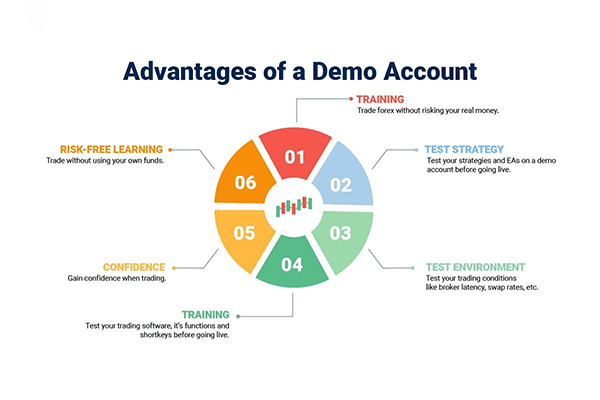

A demo account allows users to trade with virtual funds in a risk-free environment. It creates the exact live market conditions for you to make trades and test your skills and strategies.

Details:

Best for: New users or experienced traders testing a new strategy, and below you can see some of its key advantages.

When evaluating account options, focus on these conditions:

| Factor | Why It Matters |

| Minimum Deposit | Affects initial capital spending |

| Spread/Commission | Directly influences trading costs |

| Leverage | Influences risk exposure and category size |

| Execution Speed | Important for short-term trading and news-based tactics |

| Asset Access | Determines if you can trade forex, indices, metals, or crypto |

| Platform Support | Confirm your availability for Meta Trader5 or other exchanges |

| Account Currency | Some brokers offer IDR accounts in the broker forex Indonesia |

| Swap Policy | Important for fast-paced strategies and long-term investments |

Once a trader has chosen an account type, the next steps usually include registration, identity verification, funding, and platform access.

Many brokers allow traders to manage multiple accounts from the same MT5 interface, switching between demo and live backgrounds as needed.

There are various account types, and they vary from broker to broker. The best way to choose is to evaluate your needs and goals and see which one aligns the best with it. Whether you’re using a broker forex Indonesia or an international provider, aligning account conditions with your strategy is essential.

Most importantly, before completing your login Metatrader 5 setup, and placing real trades, understand the financial implications of spread, leverage, and fees tied to your chosen account. If the account is selected properly, the performance will be improved, and there will be fewer chances of sustaining greater risk. You will have control from the beginning.

There are various types of brokerage accounts, including discount brokerage accounts, full-service brokerage accounts, margin accounts, and more.

A standard brokerage account is considered to be the most common type of brokerage account.

Different types of trading accounts include equity trading, commodity trading, 2-in-1 trading, and more.