Accidents can happen and when it does, it is probably the most frustrating thing one can encounter. Not only does it harm you financially, but it also significantly affects your mental status.

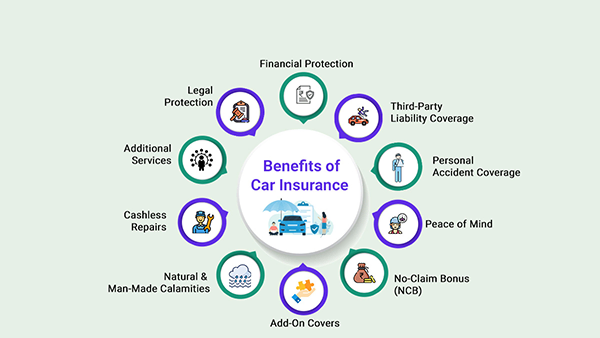

This is why, to deal with those concerning issues, car insurance comes into play to protect against any loss or damage to your car. Auto insurance policies help cover the cost of recovering your car, even if a tree falls on it and inflicts damages. Or that it also replaces the vehicle as per the clauses of the coverage if the car is beyond repair.

So, in this read, I will be exploring everything you need to know about how does car insurance policy works in the US, from its pricing system to the telematics devices.

Let’s start!

Car insurance is mandatory in literally every American state, It is a must-have to drive a car in the US. The minimum requirement according to the mandate issued by most states is a liability coverage that protects the not-at-fault driver with compensation. And, there are only a few states that require policyholders to get personal injury protection.

So, according to the minimum requirement and other improved options, there are two major categories car insurance can be divided into, let’s have a look at them one by one:

The price of the insurance policy increases with the features like higher coverage. The cost is inversely proportional to the number of deductibles the policyholder is willing to pay before the insurance coverage kicks in. It is also reduced with an increase in the limits of the coverage.

There are also other factors like age, driving habits, vehicle make, model, year, and demographics of the location that can affect the overall pricing of the car in the USA. On the other hand, some states also consider credit scores for policy pricing.

Do You Know?

The car insurance company has reached a benchmark of $155 billion industry in the U.S., where 79% of insured drivers purchase comprehensive coverage while 75% go for collision coverage.

In the USA, it is important to promptly report an incident to your insurance provider. You will also need to provide the whole documentation such as police records, medical bills, and repair estimates to process the claim.

Once you submit the documents, the insurance company will conduct a thorough investigation to prevent fraudulent claims or arson before releasing the funds for coverage. It’s also often advised to inform your insurance provider about any modifications you make to your vehicle to make sure that your claims are not affected.

For example, changing the color of your car might seem like a minor change, but it can impact the possibility of vehicle theft. Therefore, it’s necessary to keep your insurance provider informed about any modifications to your car in the US.

Telematics devices are described as tools that help in capturing the data points like driving habits, speed limit, brake application, etc, which further helps the policyholders to come up with customized underwriting for different policyholders.

Although installation of these smart devices that relay the data sets to the insurance companies is not mandatory, most companies install them for policyholders. In many cases, consumers who claim to practice safe driving were found to be reckless and cross the speed limit before the accident.

This data helps insurance companies to strengthen their underwriting standards. The insurance providers can pass the benefits of discounts to compliant consumers only when they collect higher premiums for high-risk non-compliant policy buyers.

In closing, going for proper car insurance is a smart way to recover all the major costs of the events that you can’t control. Losing all the tires of your car while it is parked in the front yard, while you are sleeping, will upset your next morning routine.

However, with insurance in place, you will get new tires. And, the best thing about this is that you will also get reimbursement for any money you have spent to rent a car till your car is fixed. These additional benefits come at a premium cost. And, depending on where you live, you need to consider an auto insurance plan that suits all your requirements. It is advisable to avoid street parking if you have a designated parking spot.

Defensive driving is not that big of a deal, it just requires the driver to maintain a safe distance from the cars that are driving around. And, also by regularly checking for safety and tests, you can keep your insurance company happy with your performance.

In addition, you can also leverage technology to find the perfect insurance policy that suits all of your requirements. Hope this helps!