I remember the time when I first heard how few people have made a significant profit by investing in a Bitcoin a few years back. I was immediately intrigued by the concept and dumped all of my money into a single coin, hoping it would be the next cryptocurrency.

Needless to say, I learned a hard lesson that how important it is to diversify your portfolio. In fact, by spreading your investment across different assets, you can minimize the effect of some specific investments that are not working. (Source: Forbes)

So, in this read, I’ll be sharing five of the most essential tips to diversify your crypto portfolio. Along with that, I’ll also discuss how these tips have helped me extract some major profits from the market.

Let’s start!

When I first heard about the potential the crypto market has, I was so caught up in the FOMO (Fear of Missing Out) that I ended up investing in a random collection of coins, which was obviously not a good idea.

So, before you go for diversifying your portfolio, it’s crucial to have a proper review of your current portfolio. This will help you identify the opportunities to diversify your crypto portfolio.

For instance, let’s take a look at this portfolio

So, at first glance, the above portfolio might seem like well-diversified. But, after giving a technical look to it, you’ll realize that it’s not.

It’s mostly Ethereum DeFi and the exception here is Polygon, which by the way also falls in the same category. Overall, this is a risky portfolio due to its strong ties with Ethereum, and it might need a little modification in it.

Cryptocurrency tokens are a digital asset that is built on the blockchain network that can be used for a variety of purposes. They usually make it easier for you to buy crypto, sell, or prove ownership of anything online — And all of that clearly and securely.

And, unlike coins that have a primary function as a store of value, token comes with some other fine capabilities. This is why it is often suggested to diversify your portfolio by spreading it across multiple tokens.

Now that you have a little understanding on what the crypto tokens are all about. Here are some of the crypto tokens that you could diversify your portfolio in.

So, to properly invest in a crypto token, you’ll be required to pick a popper fundraising mechanism. The choice typically comes from initial coin offerings (ICOs) or security token offerings (STOs)

Do You Know?

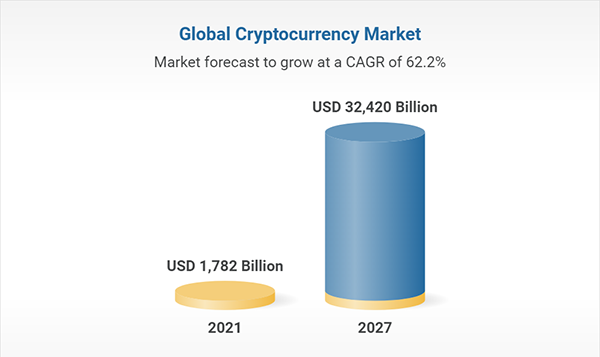

The global cryptocurrency market is expected to hit a staggering valuation of USD 32,420 billion, with a CAGR of 62.2% between 2023 and 2027.

Do you remember the time when the initial coin offering (ICO) first broke out in the market in 2017? Well, it was the time when everyone was so excited to be the early adopter of the next big thing.

While some ICOs at that time generated a really good profit for a few investors. Others turned out to be real scams or simply didn’t deliver on their promises.

So, before you consider investing in an ICO, make sure to research its team and the whole project’s blueprint. Also, try analyzing the token’s utility, distribution, and supply, as this will help you better evaluate the project’s potential.

What if I tell you that you can now own a fraction of a valuable asset — and all of that without the hassle of the traditional investment method? Well, this is possible now with the asset’s tokenization.

So, by diversifying your portfolio into tokenized assets, you can explore a wide range of investment opportunities that can help boost the overall performance of your portfolio.

After investing for a long time in the crypto market, I’ve now learned that timing the market’s volatility can be a bit difficult. So, instead of trying to predict the tops and bottoms of the market. I tried adopting a systematic approach of Dollar-Cost Averaging (DCA).

This involves investing a fixed amount of money in a particular asset at regular intervals. The strategy helps you smooth out the market volatility and reduce the impact of buying high and selling low.

In closing, as we’ve discussed in this read, a well diversified crypto portfolio is always good to maximize your potential returns. This not only helps you mitigate the risk but also eliminate your frustration of actively managing your portfolio. So, implementing the strategies mentioned in here, you can diversify your portfolio but also extract some major profits from the market.