Indeed, money is not everything, but it can significantly help you live your life with ease. While making wealth might be easy for some of you, managing it is a bigger challenge. Since I have made quite many bad financial decisions in my life, I went for Financial consulting at Randall Wealth Group trying to understand wealth making with a better approach.

Hence, you must also visit a financial consultant at least once in your life, since they help individuals like you primarily in investments, taxes, retirement, debt management, and budgeting (Indeed).

If you are not financially safe yet, you must know how to make and manage money for a better future. Keep reading to know more.

The first step to making your finances shine is to identify your financial goals and stick strongly to them. In case you already know your goals the following strategies can be of use:

Be it any investment option like equity, mutual funds, gold, or any other domain, the market is always volatile. Risk in investment is unavoidable. It’s just the degree of risk that varies with different investment options. Hence, figure out how much risk you can afford to take.

You must start to grow your money by diversifying your portfolio. Do not stick your savings to only one investment option, but divide it into different options. It also helps in managing risk. This practice is also known as asset management, where you segment the total amount of investment into different investment options.

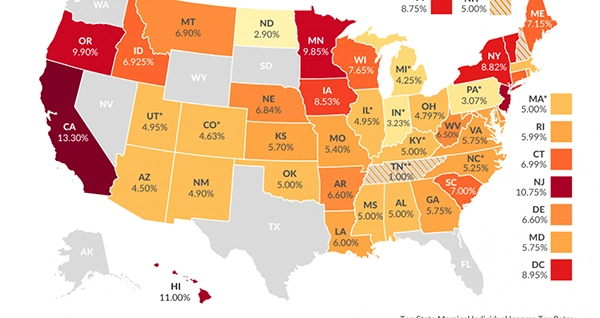

The USA is one of the most efficiently taxed countries in the world. Here, personal income tax rates rank below many European countries, so, this factor is quite relaxed, but still, cannot be ignored in your financial planning.

Hence, get a financial consultant by your side to manage these percentages and streamline your investments.

If you are living in a place where lifestyle is expensive, retirement planning is a must for you. Even for a second or third-world country, retirement might fall heavy on you if you do not have any savings.

Also, having an estate can significantly help in arranging money or having an asset by your side. Financial consultants understand the need for estate and see it as a great investment option. Additionally, reverse mortgages can provide a viable financial solution for homeowners looking to convert their property equity into a steady income stream during retirement.

Now that you know how financial goals and strategies are made, it’s time to learn how to partner with financial experts. It is quite a necessary aspect to know since advice from an immature financial expert can cause serious damage. So, follow the given tips:

If someone aspires to make financial consultancy their profession, they need to study the domain and then gain certification to win the trust of people. Not only for this but a certification projects their expertise in the field.

You can also try reading their online reviews on the web and gain insights into customer experience.

Wealth management is all about a financial service that deals with all aspects of finance, be it assets, liabilities, debtors, creditors, etc. This is where the expertise of your financial consultant will play a major role. The advice you are going for must have a sense of your needs.

Primarily, this service is a great option for you if you have a huge number in your bank balance.

Risk to health or life is unavoidable. You can live a healthy lifestyle to reduce the chances of disease or demise, but it is not avoidable. Hence, having insurance by your side is a great way to mitigate the risk of those times.

Having a medical bill is enough to waive a huge chunk of your savings. Hence, health insurance comes in handy and can help in paying either the full amount or a major share with ease.

Likewise, life insurance or term insurance can support your family with money if you are not alive for them.

DID YOU KNOW?

The USA, Taiwan, and Macau have the highest rate of insurance penetration in the world. Almost 58% of the global insurance market share is of the USA, and their insurance premiums contribute around 12% of their national GDP.

Lastly, market conditions are ever-evolving. Nothing remains the same, hence, you must plan your finances with the help of an expert to work on how change in the market or life can be sustained with the minimum financial crunch possible.

Financial planning is something that must be done by each individual to secure their future. However, finding the right financial advisor for you is a challenge in itself. Hence, you must invest your time in research and identify your needs on the basis of what is right for you.

If you like my work, please share it with your mates.