With the surpassing time, the virtual coin market is gaining popularity as it spreads its branches in nearly every economic sector. Crypto trading is also in the portfolio of some governments as this currency has excellent power to liquidity to the economy. Today Bitcoin has more value than half of the total domestic product of some nations.

After the legalization of Bitcoin in El Salvador, the nation enjoyed a great return on investment limited to large-scale business. Does bitcoin trading excite you as well? The small scale is also lifting themselves from the risk of solvency and blockage of liquidation. So, Bitcoin is so stable in the international market that even in the covid 19 pandemic, the shares remain under a certain bracket. Let’s delve deeper into this.

Traditional tender is valued according to specific requirements that decide its value in foreign exchanges. Therefore, the currency should be completing certain norms, firstly, how much availability of tender and profitability in public and private sectors.

Secondly, the scarcity of the tender is also a crucial factor in deciding the value. Moreover, how much duplication of tender is there in the open market, commonly known as counterfeiting? Lastly, how much a country owes to central banks, the International Monetary Fund, and borrowing from other countries?

A country needs to put commodities of particular value that can be tangible like gold, silver, or platinum and nontangibles like shares and securities. Initially, gold and silver were utilized to buy and sell goods and services, as they were more stable than the paper currency.

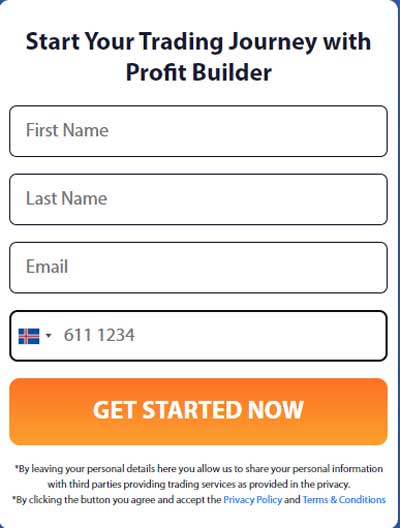

All these factors may not favor generating new tender; owing to this, a legal tender depreciates and hits both public and public sectors within domestic boundaries or overseas. You can also click on the below image to clear your all doubts:

The monetary value of Bitcoin is divided by its scarcity; yes, it is true; it is the same as you buying gold. In this scenario, there is no chance that gold will lose its value over time because there is a minimum reserve of gold all around the globe. The same phenomenon applies to Bitcoin as only 21 million coins exist in the blockchain, and not all are mined yet. Therefore, it is a scarce commodity that not every millionaire can own a Bitcoin.

Moreover, Bitcoin exists in a decentralized network that is far away from the reach of any government authority or a central financial institution. So, the government has no power to print new virtual coins. Instead, one has to go through a typical procedure to generate new coins. First, one needs to decode complex mathematical equations using the hash power of pc, which is a very power-consuming process.

If one trades in fiat currency, he must pay these pockets off tax and tariffs. Whereas, fluctuation in the rate of a legal tender can drain your funds, and you will put multiple entries of foreign exchange losses. But Bitcoin provides a stable market where you can nearly buy from bread to a private plain without paying a single penny to the government. Moreover, while doing business, you will be investing simultaneously because the recent graph of Bitcoin is crystal clear that the market cap of this currency is mesmerizing and Turning tables.

Whereas, dealing with fiat currency may compromise your private information like details of banks’ credit or debit cards. But here, with the blockchain mechanism, you will deal anonymously.

These all factors are a feather in the cap of Bitcoin. Due to this, transactions via Bitcoin are rising at a remarkable rate, contributing towards the overall increment in value. This results in Bitcoin’s upsurge in the global market and the large investor volume readily investing in this currency.

Next time, if you will buy or sell, then go with Bitcoin to ensure your best interest in all angles. Today Bitcoin is considered electronic gold, and there is no exaggeration. It is a rare mineral and can make someone a millionaire overnight. So don’t waste time trading in foreign exchange and think significant for quality today and a better future. So, grab your pc and start trading today.