You must have heard about Nvidia’s explosive rise in the stock market, pushing its market cap past $3 trillion. It’s a testament to the surging demand for Artificial Intelligence.

The global AI market is projected to grow at a staggering compound annual growth rate (CAGR) of over 35.9% from 2025 to 2030, reaching a massive 1,811.75 billion USD by the end of 2030. (Source: Grand View Research).

This immense growth raises the question: as the AI revolution unfolds, could another tech giant you already use daily – like Amazon – quietly surpass Nvidia in total market value? While Nvidia’s chips are the engines of AI, Amazon’s cloud infrastructure, or Amazon stock price is the vast ecosystem where AI lives and scales.

Thereby, this article explores the unique positions of both companies, exploring why Wall Street may already be looking beyond the hardware to the foundational platforms powering the AI future.

KEY TAKEAWAYS

- Nvidia dominates AI hardware with high-performance GPUs and strong profit margins.

- Competition Looming: Nvidia’s 90% market share will face challenges from new entrants, potentially impacting prices and margins.

- AWS is Amazon’s most profitable unit, powering AI tools regardless of chip maker, offering flexibility and bargaining power.

- Investing in AI platforms like AWS might be a stronger long-term play than solely focusing on AI hardware.

- Amazon benefits from AI across multiple business lines, unlike Nvidia’s more focused hardware segment

If you’ve been paying attention to the AI trend, you know Nvidia makes the chips that power this revolution. Its GPUs (graphics processing units) are at the core of most modern AI models. In fact, about 90% of the world’s data processing facilities rely on Nvidia chips.

Why? Because they’re efficient, quick, and unmatched in performance.

You may be surprised to know that Nvidia’s chips are also quite profitable. Nvidia maintains significantly higher gross margins than rivals like AMD and Intel, indicating that its technology is highly sought-after and that consumers are prepared to pay more for it.

That dominance explains Nvidia’s remarkable stock performance in recent years. It also raises an intriguing question…

USEFUL FACT

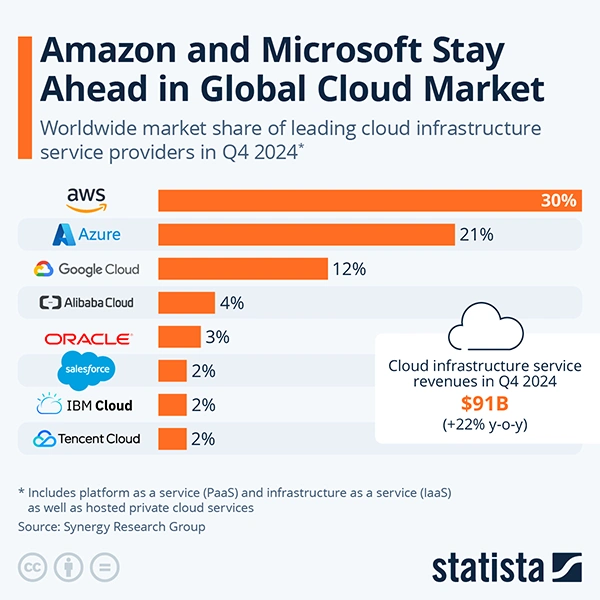

“Amazon Web Services (AWS) consistently holds the largest share of the global cloud infrastructure services market, maintaining approximately 31-33% of the total market.”

Indeed, no company keeps a 90% market share forever. History shows us that almost every tech leader inevitably faces competition. Intel once ruled the chip world until Nvidia slowly began eating into its dominance.

You can expect more businesses to jump into the AI hardware space. New startups, big names like AMD, and even cloud support providers are already investing billions to catch up. Over time, this will lead to:

That’s only how markets work. So, while Nvidia may continue to be a strong investment, it’s not the only one riding the AI wave.

Here’s where things start becoming interesting. When you have thoughts of Amazon, you most likely picture online shopping or Prime delivery. However, behind the scenes, Amazon’s most flourishing division is Amazon Web Services (AWS), its cloud computing business.

Did you know that AWS accounts for over half of Amazon’s total operating profits?

Additionally, this is where Amazon enters the AI race not by creating chips, but by being the platform that runs the AI apps, tools, and software built with those chips.

One important thing is that you might not hear on the news: AWS doesn’t really mind who wins the AI chip war.

Whether it’s Nvidia, AMD, some future competitor, or AWS, it will buy whatever chips its customers need. That affords Amazon flexibility and bargaining power, especially now that Nvidia’s top chips are very costly and sometimes take 9–12 months to deliver.

As more chip suppliers enter the market, AWS gets faster delivery, better deals, and higher capacity to serve customers. That could be a significant breakthrough for scalability.

Some analysts already suspect that Amazon’s cloud business could be as valuable as Nvidia is today. Stop for a second and think about that for a second: $3 trillion just from AWS.

Now add in Amazon’s other revenue streams: digital advertising, Alexa devices, e-commerce, and even its growing healthcare and logistics arms.

Suddenly, the idea that Amazon might even surpass Nvidia in total market value doesn’t sound so far-fetched, right?

In case you’re researching investment opportunities in the AI space, you don’t need to focus on just the hardware companies. Rather, look at the infrastructure and platforms that drive the AI economy.

This is what Amazon offers:

Additionally, unlike Nvidia, Amazon isn’t locked into one lane of competition. It benefits from AI across diverse business lines.

No one can forecast the future with certainty, but the signals are worth watching. Nvidia may continue to increase its revenues, especially as demand for AI speeds rises. But Amazon is strongly positioned to generate value above the hardware layer, and that could give it a long-term edge.

As more AI tools go to market, the platforms that scale, host, and monetize these tools, like AWS, may become even more significant than the chips themselves.

If you’re planning long-term, it’s worth asking:

Are you betting on the tools or the infrastructure that powers them?

Nvidia’s powerful GPUs are critical for AI models, leading to high demand and profit margins.

Unlikely, as increased competition from other companies and cloud providers is expected.

AWS provides the cloud platform where AI tools run, benefiting from overall AI adoption regardless of the specific chip used.

AWS can procure chips from any supplier, giving it bargaining power and adaptability in the evolving AI hardware market.

It’s between investing in AI’s core “tools”, hardware like Nvidia’s chips, versus the “infrastructure” that powers them, such as platforms like Amazon’s AWS.